What’s going on in the world? A recap of the top Bitcoin news stories this past week.

1. Fidelity releases a report on the strengths of Bitcoin

Fidelity, one of the largest asset managers in the US with $11.1 Trillion under management, released a surprisingly detailed report about Bitcoin and the importance of ‘getting off zero’ Bitcoin. These are some of the points they highlighted:

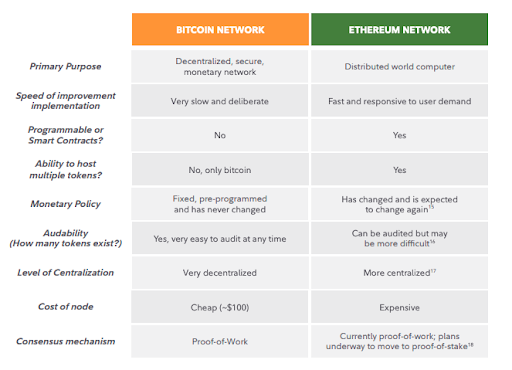

- It is highly unlikely that Bitcoin will be replaced by an ‘improved’ digital asset such as Ethereum or the other +15,000 altcoins.

- That Bitcoin may become the ‘primary monetary good’ in the long term.

- That Bitcoin beats gold in all characteristics (durability, divisibility, fungibility, portability, verifiability and scarcity). The only thing gold is better at, is its track record.

- That Bitcoin has a ‘winner take all scenario’ and ‘any subsequent good would reinvent the wheel’.

- And lastly, the difference between Bitcoin and Ethereum:

Ethereum’s Monetary Policy: has changed and is expected to change again.

This is by far the most important statement. What is the entire point of a crypto if it is not decentralised and easily prone to subjective change?

This is obviously close to all our beliefs at Bitvice and it’s great to hear an institution such as Fidelity agree on our take that Bitcoin is the only serious digital asset in the market and everything else is pretty much a distraction at this point. It has been tough to keep with our stance, when others have enjoyed the recent fruits from the altcoin expansion. But, in due time, most of these people will unfortunately see their initial returns dwindle away as the market turns back to rationality. This is not an opinion, but a statement based on historical outcomes. This is why Bitcoin always wins in the long term.

2. What the hell is going on at the Fed?

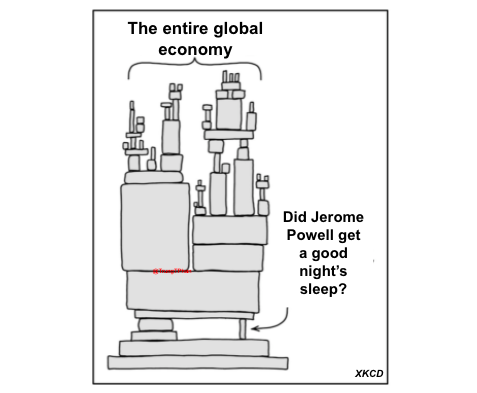

Ok, let’s take another look at the clown show that is the Federal Reserve. Every week is a topsy turvy smorgasbord of indecision and irregularity.

As I said a few days ago, the Fed will probably increase rates by at least 50bps over the next few months. They will probably begin with a 25bp increase in March. Many of the top economists and fund managers such as Lyn Alden, Luke Gromen and others agree on this.

Their biggest goal is to try and control inflation, which recently hit a 40-year high in the US. However, in the words of Hayek – controlling inflation is like ‘holding the tail of a tiger.’

No matter how this quantitative tightening affects the equity, housing and other similar markets – analysts believe that the rate increases will go ahead. As long as the credit market hangs tight, the Fed will implement controls to calm inflation. Equity markets have just been hammered the past few weeks and this was only because the Fed announced their intention to taper. It might be quite brutal for the traditional markets and Bitcoin when it happens. Or maybe it’s priced in now.

However, out of nowhere, came the announcement that the U.S Treasury ‘expects to issue $729Bn’ in Net Marketable debt from January to March (above their original estimate of $276Bn). What does this mean? Well, it means that the US Treasury issues the debt and this debt will be bought by the Federal Reserve. This is exactly what has been happening in the Quantitative Easing period we have gone through, that has most certainly been the largest cause for inflation. The Fed has basically been buying $120Bn of treasuries per month and flooding the market with the money. The moment they say that they intend to tighten this, they will flush the market with another $729Bn in less than 3 months.

This is all happening as the US debt has just crossed the $30Trillion milestone:

At this point you may realise how the hell do we all keep up with them? These announcements or intentions from these Plutocrats can’t be taken seriously anymore. These are the same people who were just caught trading their own options before announcing their own policies.

I’ve said it before and I’ll say it again. The existing market, which is more prevalent to a few men’s decisions, rather than the open, ‘free’ market – is one that cannot possibly be analysed effectively. This is why we implore as many people as possible to average in on Bitcoin, don’t try to time the markets and eventually, over the long-term, a system and asset that cannot be manipulated will eventually win.

It is prudent to be bearish right now, on everything but the Dollar. All Macro indicators are pointing to a strong decline in markets in the short term. Small caps and Bitcoin were the leading indicators for this in November/December 21 and now the large caps are starting to hurt. Just take a look at what happened to Paypal’s price on Wednesday.

When the Fed increases rates, expect some further price declines in most things. It’s probably going to be a pretty bad time for everyone. But, in the grand scheme of things – as soon as there is a point where the Fed realises their mistake (perhaps a point where the credit markets show contagion) expect an influx of liquidity once again. This is simply because a ponzi cannot be tapered.

Eventually, Universal Basic Income will become a political necessity and the Fed will also turn to purchasing equities through ETFs or alike. This is when the true ‘Japanification’ of the western world happens and we will see the complete debasement of currencies across the board.

It is at this point, where mass adoption of Bitcoin takes place.

Bitvice Media and Podcasts

Last week, Ricki had a very technical, yet fascinating discussion with Welsh Bitcoiner Ben Arc about the Lightning Network. Ben has recently been on big shows such as What Bitcoin Did and by listening to his technical insights – one can understand why. Catch the discussion on all our channels.

This week, Ricki had a long chat with Dr Jonathan Witt about The Price of Truth. Dr Witt has been extremely vocal on lockdowns and has long been a Bitcoin critic. However, he has recently turned pro Bitcoin. Watch the discussion to find out why.

Check out the discussion here or subscribe to our channels and get notified as soon as a new pod is released!

By The Horns is a Bitcoin podcast about South Africa. You can follow our discussions via video on YouTube or via the audio version on Spotify, Google Podcasts or Apple Podcasts. If you are listening on a different podcast app, here is our RSS feed.