Earlier this week, we sent out an email to all Bitvice clients regarding the Ledger hardware wallet controversy and Ledger’s controversial new service offering: Ledger …

An update on Ledger Hardware Wallets to Bitvice clients

Bitcoin self-custody solutions

Earlier this week, we sent out an email to all Bitvice clients regarding the Ledger hardware wallet controversy and Ledger’s controversial new service offering: Ledger …

Argentina, in particular, has been struggling with inflation for years, with the latest official data showing an inflation rate of 102% as of April 2023. In this environment, Bitcoin has emerged as an attractive alternative for those looking to hedge against inflation.

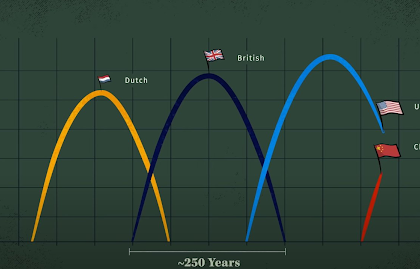

Let’s remember that the might of the United States is based on countries settling trade, but more importantly, energy, in US Dollars. Nothing is more important to the US.

Well, those pesky countries called China, Russia and others (South Africa included) aren’t listening to big uncle Sam.

Bitcoin is being attacked on all fronts. The central powers are scared – very scared.

There’s something sinister on the horizon for global markets right now. Any rational person can see it.

Bitcoin has been grappling with the Macro outlook, Faketoshi’s lawsuit and the lingering after effects of Luna and other scams that gobbled up the leverage throughout the crypto system.

However, when chatting with Bitcoiners who ignore the noise and focus on the long-term; there is still a strong presence of positivity and patience.

Let’s take a look at a few things that have been happening recently…

This bear market has ruined a lot of people. Many have been liquidated. Many have lost fortunes (but many of those fortunes were based on nothing in the first place).

As the crypto world flounders, there are some who simply don’t care what has transpired. They don’t care that Bitcoin has reached $20,000. Because they know the end-game.

The bear market. Here we are again. Or, to some, welcome for the first time.

It’s that time of the cycle, where conviction is being tested and a reality check is needed for most.

To many readers, you are here because no matter what price you bought at, whichever friend you listened to or whatever reason you think you may have bought Bitcoin; you actually bought Bitcoin for one reason. You may or may not realise it yet, but you made a bet against the current system. You hedged against manipulation. Bear markets make investors realise this. And unfortunately, this bet you made is the furthest thing from being easy.

Last week, a massive scam broke out where many users of Trezor hardware wallets were affected.

Yes, most scams/hacks occur when holding your Bitcoin on exchanges or with custodians but when custodying your own Bitcoin. The highest risk comes with human engineering. There are steps you need to take and a mindset you need to maintain, to avoid scams when custodying your own Bitcoin.

We are about to see the 19 millionth Bitcoin enter circulation sometime in the next week. And there’s only another 2 million to go, by the decade ~2140 AD, based on the supply and halving schedule.

19 million Bitcoin in supply. 2 million left. 21 million Bitcoin only. And 56 Millionaires worldwide.

In the words of Greg Foss, ‘it’s just math’.

The long term repercussions of this, are going to be frightening to many who like things to remain the same. Because this was the point of critical mass for the US Dollar and America’s hold on nations through their reserve currency. ‘After this war, money will never be the same.’