It seems like there’s a lot of negativity in many South Africans’ and Bitcoiners’ lives right now. Riots, inflation, corruption, load shedding and of course a drop in Bitcoin’s price over the past few months.

With the recent jump in Bitcoin’s price we thought we’d keep the positive momentum going by letting you know of the positive things happening in the Bitcoin space.

The fundamentals and on-chain metrics keep showing that most Bitcoin is being accumulated by strong hands or long-term holders. There was always going to be a supply shock and short-squeeze – which is what we saw on Monday morning.

Perhaps the momentum has turned?

We’ll let you be the judge of that by looking at Bitcoin’s fundamentals: adoption, censorship-resistance and security.

But first, the news!

1. The Cantillionairs talk about the B Word

This week there was a large virtual conference, The B Word where we saw the likes of Elon Musk, Jack Dorsey, Lyn Alden, Nic Carter and other figures speak about Bitcoin.

There was a fair bit of criticism on the event and rightfully so. Most of the discussions by Bitcoiners in the 9-hour event was productive, thought-provoking and argumentative at times – the way it’s supposed to be.

However, the main event with Musk, Dorsey and Wood seemed placid, one-sided and without debate.

Dorsey had a positive view on Bitcoin but did not seem to debate any of the ambiguous points that Musk raised. Wood, a large investor in Tesla, didn’t either of course.

We thought that Musk seemed to have spoken quite positively about Bitcoin when most of the community seemed to have villainized him.

Some of Musk’s most interesting quotes were:

“I’m a supporter of Bitcoin.”

“My hope for Bitcoin is a better standard of living and more power to the individual”

“You have to own your private Bitcoin keys.”

“I own Bitcoin… Tesla owns Bitcoin… SpaceX owns Bitcoin”

We are definitely behind these statements, especially the importance of holding your private keys.

However, Musk did explain his warmth towards meme coins such as DogeCoin, how it’s funny, a meme and would be an oxymoron if it were to become bigger than Bitcoin.

Unfortunately, a lot of his followers likely bought DogeCoin at its recent top and have seen this asset fall dramatically over the past few months. It is also quite sad that Bitcoin is placed in a similar category than these alternatives where there is such a clear division. One was created in 2 hours as a joke and the other has been prudently developed and upgraded over many years to help people fight central powers, enforced inflationary pressures and the continuous rise of Cantillionaires.

The most interesting discussion in our view was on self-custodying Bitcoin securely which starts at 8h10mins in this link. It’s a great talk about securing Bitcoin yourself and the fundamental importance of doing so.

2. JP Morgan just became the first big bank to offer Bitcoin to its retail wealth clients

JP Morgan has begun offering Bitcoin to retail wealth clients and have given financial advisors the green light to offer this asset class under their advisory services.

The instructions have to be client-requested and once requested, assistance can be provided.

Let’s quickly take a look back at what JP Morgan said in 2017:

And what has happened close to 4 years later:

Oh how the tables have turned…

3. Institutional adoption is growing

Goldman Sachs just released the results of a survey and found that nearly half of family offices that the bank works with want to add Bitcoin to their stable investments. 15% of respondents had already invested in Bitcoin. 22% of these respondents had collective assets under management of over $5 Billion and 45% have $1-$4.9 Billion.

Fidelity also just released a report that confirms 71% of institutional investors plan to buy Bitcoin and/or Crypto.

This is a very interesting figure to have considering the recent drop in price.

Back in 2017, there was a fairly large amount of institutional appetite but they quickly disappeared when the price dropped. It seems that there is some fortitude this time and these players are sticking to a long-term game plan.

Let’s not stop there though…

BNY Mellon and State Street, two of the world’s largest custody banks have publicly backed a Bitcoin trading platform.

ARK Invest, one of the largest investors in Tesla, just bought 140,157 shares of the Grayscale Trust in order to get an indirect allocation to Bitcoin.

NYDIG and Upgrade, a neobank have launched a reward credit card that gives 1.5% cashback for every purchase made, in Bitcoin.

The list goes on and on.

Looking at the Bitcoin side of life

There’s a lot of positive stories, events and updates that have recently happened in Bitcoin and there’s many ways to talk about them. We thought we would focus on key metrics and characteristics of Bitcoin and provide facts that point towards the network’s offering and underlying value.

Adoption

A recent survey has just been released that Bitcoin ownership in the US has tripled. It is a considerable yet measly figure of ~20 million people of 6% of the population.

Let’s now look at other countries adoption rates of active users:

- Nigeria: 32%

- Vietnam: 21%

- Philippines: 20%

- Turkey: 16%

- Peru: 16%

- Switzerland: 11%

- India: 9%

- China: 7%

- U.S.: 6%

- Germany: 5%

- Japan: 4%

The only recent stats that can be used to determine the adoption rate in South Africa is from the Treasury (which has not always been the most reliable source of info).

They estimate that there are at least two million retail investors in the country, with R2 billion in transaction volumes recorded each day. This, however, are only statistics from the large crypto exchanges in South Africa. It does not consider OTC, Peer-to-Peer and users on platforms such as Bitvice.

From this data, we can assume a minimum rate of adoption of 3% in South Africa, which is definitely a conservative number. It’s probably more prudent to say 4-5%

Also, South Africa’s Google search activity on Bitcoin has and continues to be one of the highest in the world.

So, what does this all mean? Well, most countries’ adoption rates continue to grow exponentially year-on-year but are still fairly low. That means we’re still very early and that could be a very, very good thing for Bitcoin and its price over the long-term.

Censorship Resistance

As you may know, we at Bitvice believe that it is imperative that one holds their own Bitcoin private keys to ensure that there is no intermediary between you and your asset.

It is at this point that we need to go back to the plethora of news of institutional adoption of Bitcoin. In almost all cases going forward, businesses, banks and other institutions that will build financial products around Bitcoin will do so in a custodial manner.

As you have seen with exchanges and the size they have grown to, they have been able to do so through economies of scale via custodial products. They make it easy to buy Bitcoin, in an extremely marketable manner. The user journey is much more seamless when an entity can hold your Bitcoin on your behalf. Expect institutions that offer financial products on Bitcoin to follow the same methods. And unfortunately, these entities are and will become honeypots for a variety of risks especially regulatory (clamp downs), hacks and economic risk (derivatives and more credit built on top of Bitcoin).

Our belief is that Bitcoin was meant to be self-custodied and only through that, can it become resistant to censorship.

Alex Gladestein, a popular activist who has written articles for many large publishers such as Time Magazine believes that censorship resistance is the most important facet of Bitcoin.

“I will die on the hill of privacy and free speech… In an authoritarian environment the government shuts down bank accounts of the people who are its critics. They can’t do that any more with bitcoin … Bitcoin is like a machine that turns greed into freedom.”

A great example of this is when Paypal, Visa and alike closed Wikileaks accounts due to regulatory pressures.

Julian Assange famously said:

“My deepest thanks to the US government, Senator McCain and Senator Lieberman for pushing Visa, MasterCard, Paypal, Amex, Moneybookers, et al, into erecting an illegal banking blockade against @WikiLeaks starting in 2010. It caused us to invest in Bitcoin — with > 50000% return.”

Last year you would have seen massive protests in Nigeria, against SARS (Special Anti-Robbery Squad) and the police. The Feminist Coalition in Nigeria who were fighting for women’s rights had their individual bank accounts targeted and closed by the government. They then turned to Bitcoin and were able to receive funding for their movement. It actually ended up being much more safer and anonymous for them, as there was no need for FICA, KYC and all of those lovely things.

We’ve all become so used to FICA and ‘anti money laundering’ processes now, that it’s not questioned anymore. Even Bitvice has to ask for Proof of ID and Address when you want to buy Bitcoin – as it is the current law. But the beauty of us never holding your Bitcoin and you doing that job is that at the point at which you receive your Bitcoin, it can never be held-back or taken from you. That is the entire point of Bitcoin and as more and more people face regulatory pressures globally, so will they turn to buying and holding Bitcoin – it’s only a matter of time.

The importance of Bitcoin decentralization and security

As we said in our previous newsletter, China’s recent ban on Bitcoin was one of its biggest tests yet.

The vast amount of miners that shut down their infrastructure which caused the hash rate to plummet, was also supposed to have a massive effect on its security and transaction throughput.

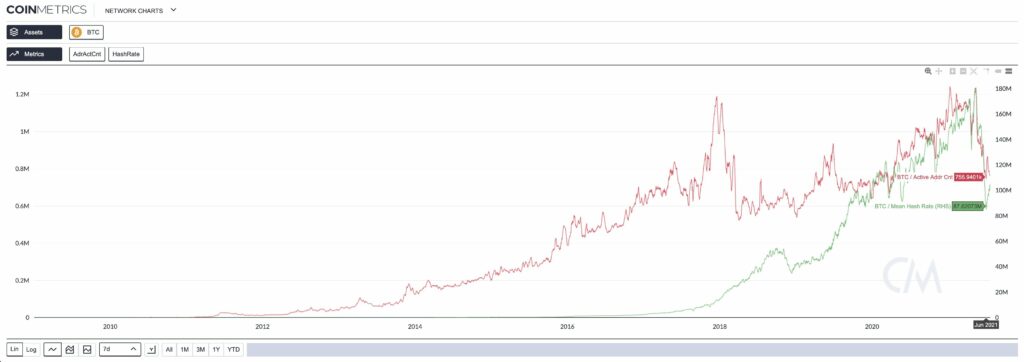

What we’ve recently seen is that this was not the case. Bitcoin blocks have stabilized, the Bitcoin mempool has not had a backlog and the hash rate seems to have found a bottom.

The number of #Bitcoin active addresses and the hash rate seem to have bottomed at almost the same time (on a 7-day rolling average).

It looks like miners have moved their hardware and are slowly coming back online. We can also theorize that the price has also found synchronicity with the hash rate.

To conclude on this point, Bitcoin has once again proven that its security is world class – and not even a country with the largest population & GDP can take it down. This will undoubtedly give much resolve to retail and institutional investors.

Bitcoin’s Price

This is probably the most interesting thing to you right now, but we are not soothsayers. We don’t know where the price will be in the next week, month and year.

We just provide you the information on the fundamentals, internal & external, to make your decision where Bitcoin is going.

We, of course, believe Bitcoin’s price is a ‘rounding error’ in Greg Foss’ words. As he has said many times, Bitcoin is extremely low in price to where it should be.

Global debt is out of control, interest rates cannot be raised, sovereign debt will increase through inflation & money printing and the Cantillon Effect will continue to provide a Smoke & Mirrors effect on a variety of assets. This is explained extremely well in the best 30-minute lesson on economics you can ever find.

Conclusion

Some of these points may be new to you, some of them you may have already heard. Nonetheless, once a decision has been made to buy Bitcoin it is important to stick to a game plan, understand the risks and to not lose focus on the fundamentals of Bitcoin. There will undoubtedly be points where you question yourself, where some Altcoin sounds better than Bitcoin or the volatility is just too tough to stomach.

We have also been through these moments. We are all humans with emotion in the end. South Africa seems like a dark place right now to many. It is in these times that resolve is needed and to try and do your best with the things you can control.

The same principles apply to Bitcoin. Those who held through horrid bear markets, who had the stone-cold belief to keep buying during the dips where the market was in pure fear – are the ones who help others understand the importance of Bitcoin and the long-term paradigm.

We hope some of these points brought a little bit of positivity to your day and we hope you keep learning about Bitcoin and its most important goal; to fix the money.

Bitvice Podcasts and Media

We had an incredible interview with Kanthan Pillay, the former managing editor of The Cape Times, co-founder of the ZACP (Capitalist Party) and a long-term proponent of free speech, self-sovereignty and an experienced Bitcoiner.

It was a lengthy conversation about the future of South Africa, how banks work and the importance of Bitcoin to store one’s wealth.

You can catch the discussion here.

This week we have a behemoth of an interviewee coming on our podcast! He has worked in Risk in the largest investment players in North America and you would have likely seen him on all the big Bitcoin podcasts. We’ll keep it secret for now, so keep a lookout on our podcast later this week!

By The Horns is a Bitcoin podcast about South Africa. You can follow our discussions via video on YouTube or via the audio version on Spotify, Google Podcasts or Apple Podcasts. If you are listening on a different podcast app, here is our RSS feed.

Book a FREE 30 min call and get the answers that you need

If you need to understand anything about buying Bitcoin, how to self-custody it securely, how to pass it on to beneficiaries or any other relevant items, we are offering a free 30-minute one-on-one Q&A session with our co-founder, Ricki.

He will be able to answer any questions you may have about Bitcoin.

If you wish to take him up on this, schedule a call with Ricki by clicking the link.

Keep on HODLing, keep on Learning and keep on Stacking.