This week we want to focus on helping you keep your Bitcoin private. We have continuously focused on helping you keep your Bitcoin safe and secure but privacy is just as important.

There will be a great deal of regulatory risks and rules that will make purchasing Bitcoin more bureaucratic and laborious as time goes on. Governments and entities will do so through standard ‘KYC – Know Your Client’ processes, just as the banks do. There will also be other burdensome protocols enforced upon us – no doubt.

If you are buying Bitcoin now, then we’re here to help you understand how you can increase your privacy from their Orwellian eyes.

But first, the news.

1. The recent short squeeze and exchange outflows

It’s been an exciting few days for us all as Bitcoin has jumped from $30k to the low $40k mark. Many believe this is the first step out of the recent consolidation period, which has provided a solid foundation for the next leg of the bull market.

We saw a greedy few set some serious short volume on relevant exchanges and that greed quickly turned into hurt for the bears. The recent price jump liquidated an enormous amount of short sellers which catalysed into a short squeeze that many believed was coming.

The short squeeze on Binance led the price to $48,000 on the Binance USDT margined perpetual.

It seems some bullishness has returned to the market, but there’s still quite a lot to get through, to get back to the $64k recent high. It’s the patient HODLers that are in control now.

2. The US ‘Infrastructure’ Bill

Whilst most of us are optimistic after the last few days, there are relevant concerns about proposed US legislation through the ‘Infrastructure Bill’. The Bill is primarily focused on providing money to capital projects but there are other hidden elements in the thousands of pages of the Bill.

“A new provision has been added that expands the Tax Code’s definition of “broker” to capture nearly everyone in crypto, including non-custodial actors like miners, forcing them all to KYC users.” – Jake Chervinsky

In summary, the proposals are heavily in favour of KYCing every participant in Bitcoin, centralising and controlling their data – which places a lot of risk on the end user.

Those who understand Bitcoin and what the point of it is – will know that users are pseudo-anonymous and access to Bitcoin is permissionless – the way it’s supposed to be. Regulators will clamp down at every on and off-point of Bitcoin to make sure they know exactly who is buying, when and where.

They also are seeking to clamp down on miners through bureaucratic processes such as the IRS Form 1099s and Chervinsky argues that miners, who are non-custodial in nature, cannot complete these forms. Thus, this indirectly bans mining in the US.

It is important to remember that these types of regulations are pushed by a select few with personal mandates to protect their own interests [insert the Banking Industry].

The ones in power believe they can control something that is inherently uncontrollable through autocratic and archaic legislation. This is what they do with everything else and so they believe this will work with Bitcoin too.

I believe that Bitcoin will ultimately win against these actors, but there will be hardship. It is important to keep as anonymous as possible in Bitcoin and that is why we are focusing on privacy in this newsletter.

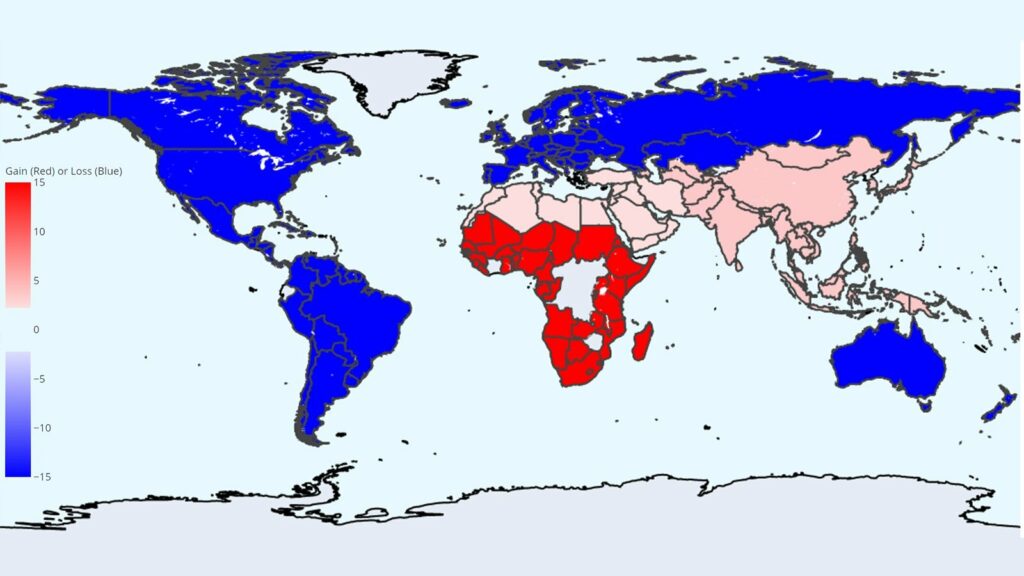

3. Africa has the largest peer-to-peer volume growth in the world

Africa’s peer-to-peer volume has grown more than any other area in the world. This is absolutely fantastic news!

I personally believe that Bitcoin can help so many poorer nations escape fiscal embargoes via other nations such as France, China, the US and so on.

It is also the best tool to escape enforced inflation and corruption by governments.

Let’s hope this pattern continues, that the youth continue to adopt Bitcoin and secure a better future for themselves and their families.

Protect your privacy, protect your Bitcoin

As stated earlier, when we quickly discussed the US Infrastructure Bill, it is incredibly important to buy Bitcoin privately and to maintain this privacy going forward.

As we can all see in the current banking system, we are relentlessly pushed into verification via KYC and unnecessary reporting by so many different bodies.

We at Bitvice have to ask for your Proof of ID and Address when you purchase Bitcoin through us – it is the current law. We do this because we want to help as many people buy and secure Bitcoin for themselves, in a legal manner.

It is quite unfortunate that we need to ask for your identification and to be honest, we don’t like the fact that we have to. But, with this – we can always provide you with clear and precise reporting for your use where you need it. We will always make sure to secure your details with best practices and to never share it with third parties.

With all of that said and done, let’s talk about the importance of Bitcoin privacy.

Why is Bitcoin not private?

Bitcoin is a transparent and immutable ledger (blockchain) that maintains a balance of credits and debits to addresses on the blockchain. The blockchain is transparent and open to anyone with an internet connection that wants to view it. Because it is transparent and confirms the amount of Bitcoin in every public address – it is far from private.

Yes, it is pseudo-anonymous as it only confirms the amount of Bitcoin in each address. But, if you are KYC’d at an exchange, buy Bitcoin and move the Bitcoin to a new address – you are then connected to that public address.

The blockchain stores all transactions dating back to 2009 and so if a transaction from an account that is linked to your ID is linked to your end account – so can other people determine how much Bitcoin you have.

Why Privacy is important

Well, if you are like most people – it is probably correct to say that it is not good for other people to know how much money you have.

Yes, people who work at your bank may know how much money is in your bank account and only them. But if you move your Bitcoin off an exchange that KYC’d you and you do not use their services anymore, you would not want them to know how much Bitcoin you have.

However, as all transactions are recorded, they can track your Bitcoin from their wallet across many wallets over any time period – due to the transparent Bitcoin ledger.

What if you also pay for a coffee at a store with Bitcoin? The coffee store can see where the Bitcoin came from and how much Bitcoin was in your wallet as well – if they looked on the ledger.

This methodology of Bitcoin’s accounting system is through something called UTXOs.

It is a big problem in Bitcoin and is a necessity in order to remain decentralised and remove all intermediaries.

The good news though, is that there is a way to increase your privacy.

Methods of privacy

First of all, please be aware that the proposed tool/s for privacy are for the more advanced user, who understands Bitcoin quite well and is happy to take on any risks.

Please do contact us at support@bitvice.io if you do want to increase your privacy, but still need a few questions answered.

Step 1 – Segregation (simple)

99% of Bitcoin wallets will automatically provide you a new address every time you request to receive funds. This is through something called Bitcoin Derivation paths. Essentially, these are different addresses that are linked to one another. Essentially, it is a type of wallet where you have a single seed phrase (i.e 24 words) that unlocks a number of accounts.

If you keep providing new addresses for your one multi-sig wallet, every time you receive Bitcoin – it will increase your privacy as there is a new ‘branch’ every time you receive Bitcoin. This makes it very hard for people to track your total Bitcoin and also for the coffee shop owner to not know how much Bitcoin you actually have.

To conclude on this point, we advise updating your Bitcoin address on your Bitvice dashboard before every new order. We don’t ask questions, we simply send the Bitcoin to the address you request. Please note that after making an order, you cannot change your Bitcoin address whilst the order is in progress.

Step 2 – Separating you Bitcoin from its history (more advanced)

Coinjoin is a tool that is used to increase your privacy through grouping transactions. To put it simply, two or more users pool their UTXOs into a grouped transaction that is formed in a unique way.

The transaction is constructed in such a manner that when the Bitcoin is returned to the individuals, it is hard for on-chain surveillance entities to know exactly which transaction output belongs to which owner.

If you want to learn more about Coinjoin please watch this video.

So to summarise, a person normally signs up to a Bitcoin provider and provides their ID and Proof of Address. When a withdrawal is initiated to their own address, the Bitcoin is now tied to their identity across space and time.

If they were to then Coinjoin and receive the outputs to another address – the link to the original ‘KYC’d’ address is now broken.

Notes about Coinjoin

- There are fees involved and one should be aware of what these are before entering into a Coinjoin. It is best to do this type of transaction during a period where Bitcoin’s mempool is empty and the Sats/Byte levels are low.

- Your spending habits after a Coinjoin is just as important. If you spend your Bitcoin at a provider who KYCs you, then the link to identity is now open again.

Methods of Coinjoining

*Please contact us at support@bitvice.io if you are considering this but not 100% sure of the process.

Android (there is no option for iOS currently)

- Download Samourai Wallet

- Calculate your Whirlpool fees based on your chosen amounts and pool sizes

- Send some bitcoin into your wallet as outlined earlier

- Click the blue + and press Whirlpool

- Once Whirlpool loads, press the icon in the bottom right corner

- Press mix UTXOs

- Select which UTXOs you want to mix

- Pick how quickly you would like the mix to be initiated

- Review the transaction details

- Begin cycle

- Press yes to the box asking if you want to mark your change as ‘Do not Spend’

- Your mix is now underway and you will see your mixed sats in the postmix section of your wallet after a short wait

- If you leave your funds in postmix you will be eligible for free and unlimited remixes (chosen at random)

There are other methods of privacy but these are the most popular and trusted options. Please ensure you understand the steps and always test everything with small amounts before you jump in completely.

Privacy in Bitcoin is and will become one of its most important factors in fighting the banking system and to protect yourself against regulatory risk – which will become bigger and tougher over time.

Privacy is also a human right and should always be so. It is our every right to keep our own things private including our money and wealth.

Bitvice Podcasts and Media

Last week was our best Bitcoin podcast to date with the Canadian Boss, Greg Foss.

Greg is a large figure in the Bitcoin community and he brings so much experience to Bitcoin after spending decades trading risk for Canada’s largest financial institution.

We discuss how the Bonds and Credit markets work and how Bitcoin is the best investment option he has ever seen in his life.

You can catch the discussion here.

Book a FREE 30 min call and get the answers that you need

If you want to discuss Bitcoin privacy or have any other questions, please feel free to connect with our co-founder Ricki for a free 30-minute call.

He will be able to answer any questions you may have about Bitcoin.

If you wish to take him up on this, schedule a call with Ricki by clicking the link.

I hope you have a great week further and I want to leave you with a quote from Geoffrey Fisher, the former Archbishop of Canterbury:

“There is a sacred realm of privacy for every man and woman where he makes his choices and decisions — a realm of his own essential rights and liberties into which the law, generally speaking, must not intrude.”