What’s going on in the world? A recap of the top Bitcoin news stories this past week.

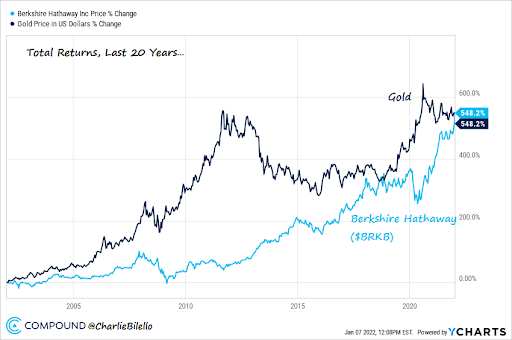

1. Berkshire Hathaway vs. Gold

I’d like to kick off the news this week with a fascinating chart, shared by Charlie Bilillo, the Founder of Compound Capital Advisors.

This is a 20-year view of the returns one would have made if they invested in the ‘greatest’ investment manager, Berkshire Hathaway (Warren Buffett) or if they simply bought some gold.

Berkshire Hathaway 20-yr return: 548%

Gold 20-yr return: 548%

Quite scary, isn’t it?

I want to draw your attention again to this incredible thread that shows the fallacy of the traditional markets in a world drowning in inflation.

What about Bitcoin? Well, it hasn’t been around for 20 years – so a comparison can’t really be made.

However, since 2013, when Charlie Munger (also of Berkshire Hathaway) called Bitcoin ‘Rat Poison’ – it has provided a return of 36,900%

Enough said.

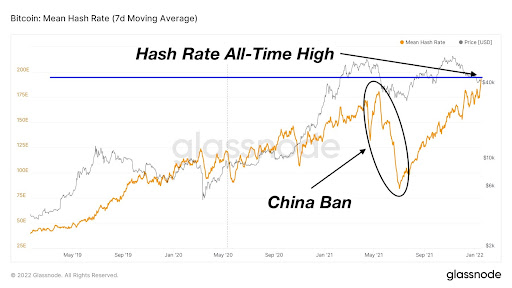

2. Hash Rate continues to climb

Bitcoin’s hash rate continues to show incredible strength, proving more miners are entering the fray and injecting an incredible amount of capital into Bitcoin’s network and its security.

I know, I know. Not the hash rate again! Can’t you talk about something else?

Nope, we want to keep focusing on the fundamentals. Not technical analysis or vapid articles that bring hope to Bitcoin’s price reaching the moon.

Looking closely at the incoming miners, they seem to be quite geographically dispersed – unlike it was before China’s ban. This is an extremely bullish factor for Bitcoin’s decentralisation and defence against central planners.

3. Computing monolith, Intel, turns to Bitcoin mining

And lastly, with a continuation on the above, a $240 Billion company, Intel, just announced they are entering Bitcoin mining.

They will be introducing an ‘‘ultra-low-volatage-energy-efficient’ ASIC which is specifically designed for Bitcoin mining.

There are currently two main ASIC manufacturers in the world right now – Bitmain and MicroBT, both Chinese-based.

Jack Dorsey (Twitter, Block) has also begun forming a team to build the next generation of Bitcoin mining ASICs.

Once again, this is what secures the network. Where there is strong competition and sound products, there is a robust environment for innovation.

Expect more big players to enter this market soon or through FOMO upon Bitcoin’s inevitable rise in price.

Bitvice Podcasts and Media

Last week Ricki chatted with Carter @Stateproofstoic about the changes that he has made in his life over the past few years to reduce his reliance on the state as much as possible. Carter dives into homesteading and what can be done relatively easily to start you on your journey toward increasing levels of self reliance.

Check out the discussion here or subscribe to our channels and get notified as soon as a new pod is released!

By The Horns is a Bitcoin podcast about South Africa. You can follow our discussions via video on YouTube or via the audio version on Spotify,Google Podcasts or Apple Podcasts. If you are listening on a different podcast app, here is our RSS feed.