Bitcoin is ‘dead’ again.

This bear market has ruined a lot of people. Many have been liquidated. Many have lost fortunes (but many of those fortunes were based on nothing in the first place).

As the crypto world flounders, there are some who simply don’t care what has transpired. They don’t care that Bitcoin has reached $20,000. Because they know the end-game.

This week I take inspiration from Allen Farrington’s masterpiece, Only the Strong Survive, which is a fairly lengthy read. You can also catch the audio version here: Part 1, Part 2, Part 3.

It was written around a year ago, way before anyone had a hint of bearishness in them. The crypto world was going crazy. And the author, along with many other Bitcoiners, were warning everyone about the fallacies of crypto which we are seeing now.

It looks into the fundamentals of Crypto and why Bitcoin is completely separate from the rest. Many of his theories are playing out now; and we’ve seen some Crypto companies/securities (yes, I do consider them that) completely implode.

Some have lost the same value of the 90’s disaster, Enron, a global event where $70Billion was wiped off the market. The recent collapse in the crypto Ponzi, Luna, led to $80Billion in market capitalization being wiped out.

Let’s take a deeper look into this all.

What caused Bitcoin’s price to drop? What is the end-game? And why do only the strong survive?

Bitcoin has pressure on 3 fronts

Bitcoin’s price plummet to $3000 in 2018 was primarily due to the Fed tightening at the time as it was categorically bucketed by the market along with all other crypto. Most of the market deemed it vapourware, a useless experiment without much adoption.

In 2020, it dropped +50% in a matter of days to a once-in-a-generation, black swan event with a global sell-off on all risk-on assets.

Now, in 2022, we’re facing a 80-100 year complete global, macro shift from a period where Dollars are suddenly hard to find. The world is facing tightening from most central banks, stagflation across the board and inefficient supplies from underinvested commodity providers. This means the world is scared and is once again, seeking refuge in the Dollar.

#1: The Dollar

Inflation is roaring across the globe and currencies are being devalued at a massive scale.

The DXY, however, is currently at a 20-year high. People are seeking refuge in the Dollar and the DXY is showing it. However, the DXY is rising against the Euro and Yen which means it is devaluing at a slower pace.

Nonetheless, when the Dollar goes up, Bitcoin goes down. Simple.

#2: Shitcoin degeneration

We’re closing in on 20,000 different cryptos as stated on Coinmarketcap.com. This alone is palm-on-your-face ridiculous.

Now, it is quite clear at this point, based on every sign and many of my past newsletters as well, that the Fed and other central banks QT policies were a large catalyst for Bitcoin’s price moving back towards its median.

Bitcoin is still new to most. Only around 2% of the world has adopted it, and this is an optimistic estimation. Many newcomers and institutions still bucket Bitcoin alongside crypto and thus, it will be affected by it – until it isn’t.

Now, let’s take a gander at the absolute lunacy and degeneration that took place in crypto over the past 2 years. All the signs were there that this was a bubble that needed to burst.

Bitcoin was the frontrunner

At the trough of the 2020 market sell-off, central banks opened a floodgate of liquidity and Bitcoin quickly became a solid hedge against that. Bitcoin’s price quickly escalated in Q2-Q4 of 2020 and at the beginning of 2021, we saw Bitcoin skyrocket from its previous high of $20k. It was at this time that the retail market and a lot of newcomers saw potential in the other cryptos.

Food Farms

As the ICO craze of 2017 was a scheme of the past, crypto founders had to push a new narrative. The narrative to come was decentralized finance and the magical word, ‘yield’.

They created decentralized exchanges (DEXs) and decentralized autonomous organizations (DAOs) which were fancy upgrades to archaic, manual ponzi schemes that socialised investments into yields through socialised marketing. This is when we saw things like ‘Sushi, Shrimp, Beefy, Yam’ and other tokens that were so ridiculous that most would think it a warning sign. Unfortunately, this was only the beginning.

Many tokens were created through decentralised exchanges, which were the furthest thing from regulated. This allowed many VCs and large players to move their funds from one low float token to another, which drove the marketcap of these tokens to over a Billion dollars each. This was pure manipulation, but many newcomers saw tokens with such high marketcaps and a sense of trust and optimism came over them. So, they piled in retail money into these different tokens, further driving up the price.

Doggy coins

With the world flushed with fiat from the central banks, a sense of euphoria was washing over many across the world.

People were locked up in their homes and they needed something to do.

Attention spans were short and the manipulators needed to come up with new ideas quickly.

Elon Musk was joining the craze and seeking attention on Twitter. He was tweeting about Dogecoin and its ‘financial properties’. This is when new doggy coins were created.

Things like Shiba and other tokens similar to Dogecoin were created. Shiba grew into an absolute behemoth. The world went crazy. Exchanges added these new tokens to their offerings as quickly as possible to harvest investor fees. Vitalik Buterin had some fun with this token as well. I would suggest googling it if you want to learn more.

Some might have thought this would be the top, but the clown world would continue its journey.

NFTs

Now, this was the funniest one of them all. The most annoying acronym as well. JPEGs that somehow found value. This was the process of ‘HyperJPEGization’.

The no-cost, immaterial movement of ‘art’ had no fundamental value, other than the hype it brought to the inexperienced retail market. Many signs were there that this form of asset was one of the best use cases for money laundering (google that as well) and in the end, it was just a race to buy monkeys.

The cracks started forming

New chains, tokens, DEXs and DAOs were being created faster than bankers’ lies.

Billions of dollars were being locked into yield-providing mechanisms that were so error-prone, hackers were having the time of their lives.

The Ronin hack led to 650 Million dollars being lost due to lazy management of private keys.

Inflation started to take hold over all of us and the central banks started their narrative over raising rates and buying less government bonds.

LUNA, as discussed in a previous newsletter, was the beginning of the end as its algorithms failed and the yield-bearing ponzi imploded within weeks, wiping tens of Billions of dollars off the market. The central players in this ponzi had to sell thousands of Bitcoin, further driving all prices down. It was at this point that newcomers started to ask, where did the yield come from in the first place?

They should have been asking that from the start.

Because the market was young, optimistic and nonsensical; it took LUNA 1 year to execute what Bernie Madoff did in 40 years. Many lessons have been learned but unfortunately most have a short memory.

Now, because of cross-chain leverage at such an enormous scale in all shitcoins; there was massive contagion. Service providers who held people’s Bitcoin, lent it out to institutions, earned interest and paid a cut to their users (yield) are in dire straits now.

Celsius, an unregulated service provider which at one point was worth $10Billion, is one of these providers. They have hundreds of thousands of users who trust them with their Bitcoin. They halted all withdrawals and are holding all of their users’ Bitcoin, with no clear explanation as to when or how they will release their assets. They were closely tied to LUNA and USDT, through a layer of other players and hedge funds (Three Arrows Capital etc.).

The $80Billion eradication of LUNA and its value has left bag-holders with nothing but a lot of debt. It’s now the end-user, the retail individual, who ends up with nothing but sweaty palms and a sense of hopelessness.

Other yield-providers such as BlockFi, who hold people’s Bitcoin, are still in operation, but have also been hit hard by this absolute shitstorm of over-leverage. They have had to accept $250Million from one of the biggest exchanges in the world, FTX, to keep the lights on. Voyager, another custodial yield provider lent half of its loans book to Three Arrows Capital and due to this ungodly position and the collapse of 3AC, they have also just been bailed out by FTX.

This further drives the interoperability and cross-leverage between all of these providers. Much like the banking system before the 2008 crash. The analogy is right there in front of our faces.

In 2017, it was the creation of equity based on no fundamentals through ICOs. In 2021/22, it was the creation of yield-making mechanisms, with no fundamentals. The flow of funds into these schemes by retail (in other words the capitalization) was taken by the schemsters, collateralized and then used to create more capital which was then sold back to newcomers. They took these gains and then paid the yield to the initial investors. The 2022 yield craze, a. lovely little Ponzi ain’t it?. I wonder what will befall the naive in 2026.

All of these shenanigans by a market of manipulators and inexperienced retail users has had a massive effect on Bitcoin’s price. The same will probably happen again in the future, when the banks turn the taps back on and the clown world continues. It is only through the ebb and flow of euphoria and destruction that Bitcoin will eventually separate from the rest.

#3: Central Bank policies

And once again, we can point our fingers at the chief architects of it all.

Now, I’ve warned about the Fed and other central banks for some months now and I simply have to look at them again.

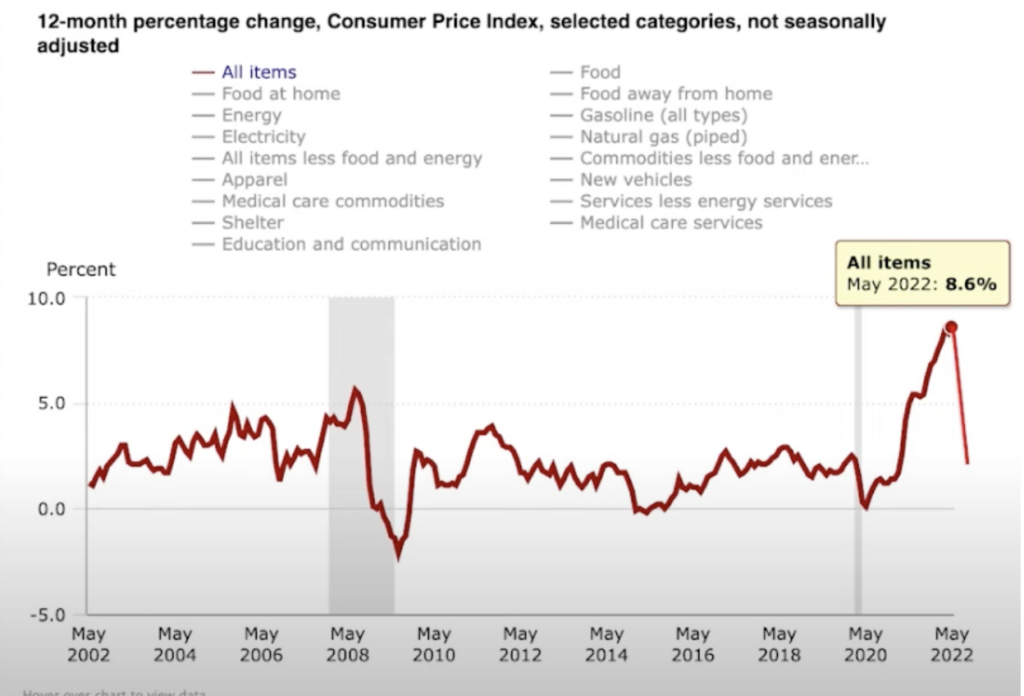

Inflation is out of control globally.

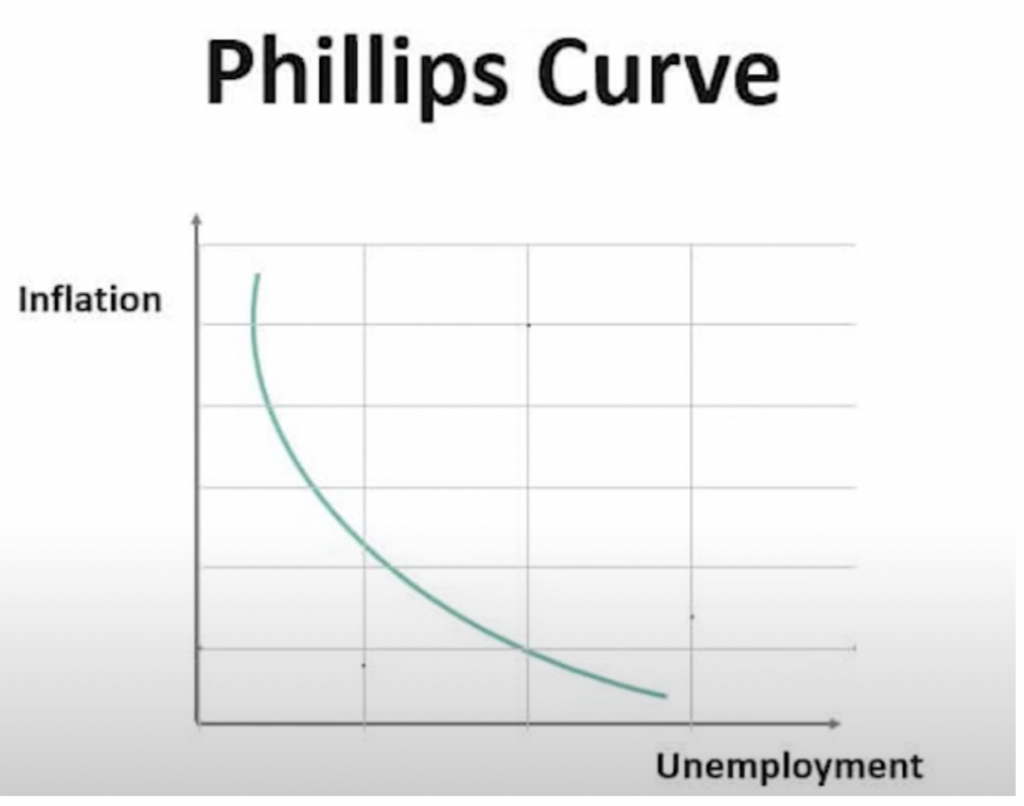

The mandate for the Fed currently is (and always has been) to control inflation and unemployment through duality.

Every economics book illustrates that central banks control inflation through unemployment. The lower the employment rate, the lower the demand for goods and services and the lower inflation should go. The opposite is true as well.

Now, this is a basic method which has been with us for over a hundred years. It always seemed to have worked, right?

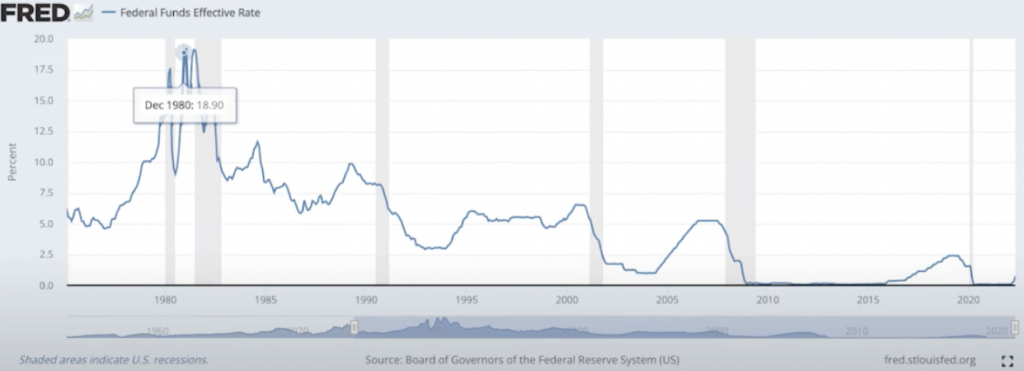

In the 80’s Paul Volcker famously raised funding rates towards 20% which eventually managed to overcome similar inflationary rates that we are seeing today.

The Fed, who recently raised rates by 0.75% is trying to do the same. They are aiming to do another 75bps hike at the end of July, bringing the federal-funds rate to 2.5%.

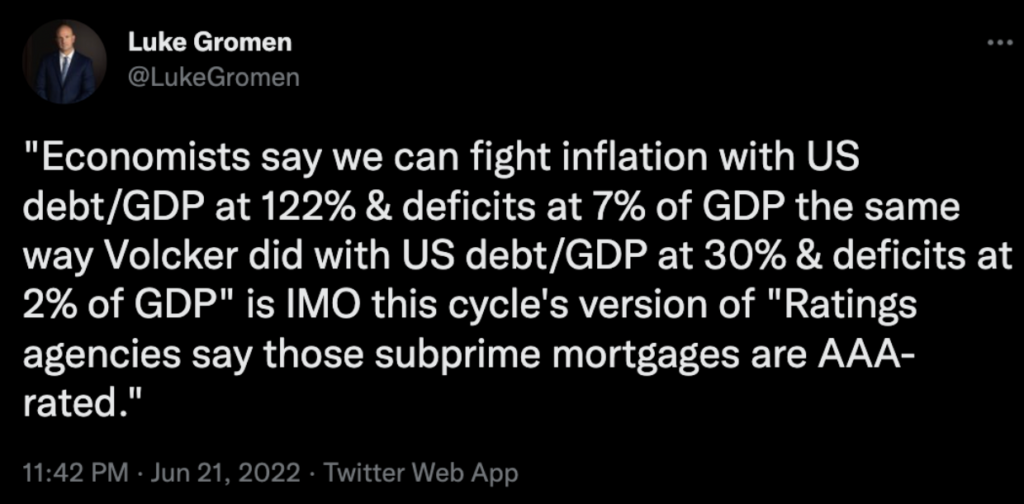

Luke Gromen explains the issue quite succinctly. The 2020’s are not the same as the 1980’s. The world is in a completely different situation. Debt is out of control and the other issue is the current effective increase in rates.

In the 80’s, when Volcker took over the Fed Chair, the benchmark rate was close to 11%

Raising the rates from 11% to 12.5% is not the same as raising it from 1% to 2.5%. The latter is effectively a 150% increase in 1 month.

In the two years that Volcker increased the rates from 11% towards 20%; this was less than a 100% effective increase.

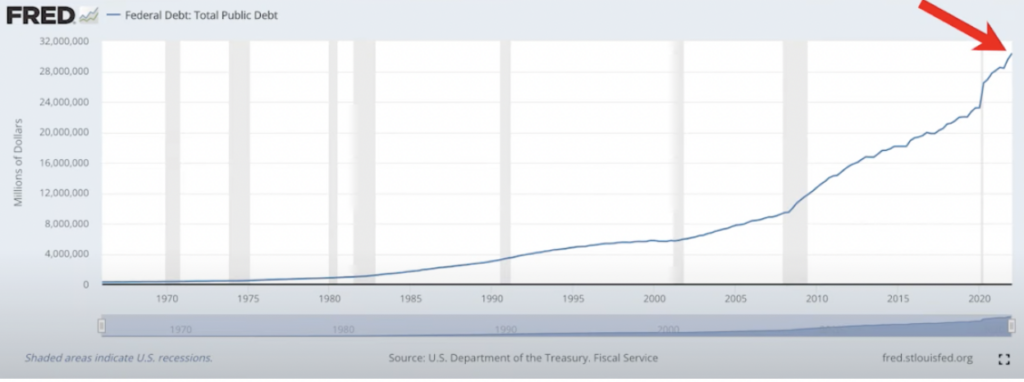

The other elephant in the room; is sovereign debt level, or in other words, the debt in the system. We’re at unprecedented levels and there seems to be nothing stopping it.

Have a look at the US debt:

Consumers, businesses and governments are at debt levels where any sustainable increase in interest rates would be unaffordable. The Fed and other central banks know this.

Just watch Christine Lagarde try to answer a simple question here. It is utterly insane that someone, who is managing close to 9 Trillion Euros on the ECB’s balance sheet (82.4% of the Eurozone’s GDP) can look so obtuse and confident at the same time.

These central bankers, who said inflation was ‘transitory’, are just a new form of politicians trying to keep a crumbling framework in place. Their new mandate is just trying to convince the market that they are the ones in control.

Unfortunately, the truth will eventually come out.

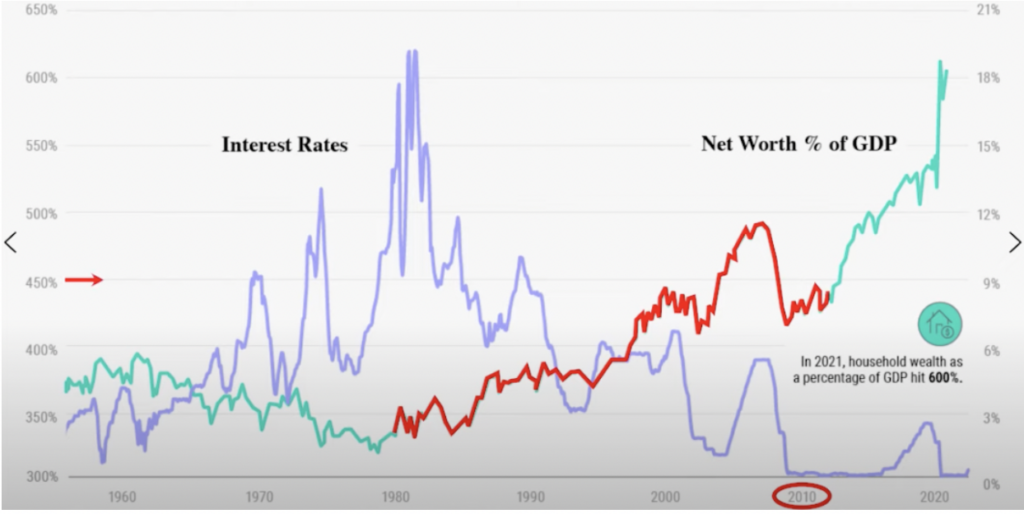

What has likely happened since the 2008 financial crisis and the biggest monetary expansion in human history; is a change to the way things work.

As fiat money flushed the system over the last decade, it seems as if the tools of the central planners have changed from employment & inflation control; to asset prices & inflation control.

As more fiat entered the system, the US economy directed this into housing and especially the stock market.

Asset prices have catapulted the US Networth against GDP, to over 600%. This ‘hyperassetization’ has now become the bigger boss to fight for the Fed, than employment levels.

Their new mandate seems to be to bring asset prices down, in order to bring inflation down. All signs are pointing towards this. They now believe that lower asset prices will mean lower liquidity, lower demand and thus, lower inflation.

This makes sense in the current environment. Interest rates can’t be increased significantly. Driving unemployment would be extremely unpopular for constituents, especially with the upcoming US midterm elections. So, one can see why asset prices have seen blood these past few months across the globe. Risk-on assets have seen the worst.

Bitcoin was the leading indicator for this.

The housing market, which always lagged the rest, is starting to signal warning signs. Mortgage rates are up 3% in the US. In the past, for every 1% increase in mortgage rates, there has been a 10% decrease in average property prices.

We have certainly entered a recession and anyone who says otherwise is unburdened with clarity.

These three things have been brutal on Bitcoin and this is simply the reality we have to face.

Now, what happens next?

Well, I don’t know for certain. Anyone who says they do, is selling snake oil.

But we can theorize what happens next, based on history and one fact alone: the mandate for those who are in power, is to remain in power.

We can base the probability of future outcomes on this.

When looking at the Dollar, I’ll keep it simple.

I wrote about the Dollar in a previous post and why it is doomed in the long-term. In the short or even medium term, it’s a good bet; because the world has always flocked to it in times of distress.

However, bad times have to end eventually; likely through short-term, ineffective means. Money is changing. It is changing through Bitcoin and it is changing through a shift in the world order.

US Treasury yields can’t go back to previous levels – the obligation would be too much when debt levels are so dangerous. People will flock to new asset classes with better yields, the Petrodollar will likely implode and when the dollar goes down, Bitcoin tends to go up.

With central banks, they will continue to signal their intentions to the market through different forms and methods. Eventually, as the world realises that rates can’t go back to where they were. As the world exits bond markets into other assets, that money printing is the only answer and the ‘Weimar Republic’ is knocking on our door.

The world has evolved into a globalised, over-indebted, highly unequal hodgepodge around Keynesian policies. I cannot tell what will happen when the game is up.

However, the world saw the Renaissance before the Federal Reserve was formed. Since 1913, the world has seen countless wars funded on fake money that would have simply been unaffordable on the gold standard, where they could only have been funded by taxpayers. Maybe the other side of the great reckoning ain’t so bad?

Those in power will do anything to keep the current system in place – no doubt about it. They will see Bitcoin as a primary enemy as it continues to do suck in liquidity from gold, bond markets and other asset classes. They will drive the ‘Bitcoin is bad for the environment’ narrative like nothing before.

As Ethereum moves away from Proof of Work to Proof of Stake, their users will join this side and begin their attack on Bitcoin as well. This I am sure of.

There will be a barrage of attacks from every side and doubt will seep into many minds over and over and over again.

Only the strong survive

In these dark moments, once again, we need to remember that those in power will do anything to remain so. We are at the pinnacle of centralisation.

With COVID, whether you agree or disagree with what governments did, is not the point.

It is how they did what they did, that we need to focus on. Their solution for every problem – because all problems to politicians are short-term – is to print money. We (and they) are trapped in an inflationary environment where more money needs to be printed in order for them to remain in power. There is no other way.

It is because of this conundrum that chaos ensues. We need to make this clear. Without a monopoly you wouldn’t have the potentiality of hyperinflation which has happened 100 times before. You can never tell it when it may happen. But it will come. And 2020 taught us Bitcoin is a leading indicator of inflation.

There will be a rush for the exits, for things that cannot be debased in a world that has minimal trust.

People will turn away from the easy, to the hard. There will probably be more than 50,000 cryptocurrencies at this point and Gresham’s law will take full effect; good money keeps out the bad.

Remember, Bitcoin’s run for the last 13 years has been on a foundation of the largest monetary expansion the world has ever seen. It is in the biggest test of its life now, with macro conditions that it has never seen.

Bitcoin faced similar challenges in 2018, then the Fed raised rates. This caused its price to plummet by 80%. The current environment seems to be a lot worse now.

We are in a game of Russian roulette now. However, you don’t need to hold the gun. You simply need to wait for the bankers to pull the trigger on themselves.

There will be those who think that Powell is Volcker. That raising rates will be the only needed tool to bring the world back to order. That the 60/40 portfolio is all one needs. Perhaps Bitcoin is not for them. And that is fine, there’s nothing wrong with that. Their choices are theirs and theirs alone.

For those who think the world is changing. That the potential outcomes of these changes are clear, then perhaps Bitcoin is for you. But be aware, gold bugs and alike have been calling for the end of this system for a long time. They were probably right but just too early. These changes are made in increments and take time, until some spark happens and then gradually turns into suddenly.

In preparation, when one chooses Bitcoin, it should be nothing but for the long-term and in a self-custodial manner.

Regulation will become unbearable as the central planners lose their grip. Crypto will fall under securities regulation. Some providers will continue to implode without any bailouts – losing all of their users’ Bitcoin. All of this will happen when times are good and even when times are bad.

In the long-term, a position and mindset in self-custody and patience is vital to keep conviction in check.

There will be many temptations along the way. New shitcoin schemes will bewilder those who are prone to distraction and who think a quick buck is easy for the taking.

And in the long-term, there will be moments where hope is at its lowest with Bitcoin. When you simply want to get rid of it. Throw it in the bin. Maybe that moment has happened. Maybe it’s happening now.

If not, it’s likely to come.

The strongest survive in those moments. They know what the end-game is.