Firstly, and most importantly, you can expect the unexpected. Bitcoin has proved many people wrong in 2021 and will do so again in 2022. No one knows what will happen with the price (especially the open-mouthed analysts on Youtube), but one thing is sure – the network will continue to confirm blocks every ~10 minutes and everything else will fall around that.

I am not an oracle and none of the following should be taken as advice.

I am simply a guy, like many others, who utilises the information in front of him to determine a likely path forward. The probability of being right is most certainly smaller than being wrong.

With that said, it’s still fun to think about the possibilities:

What will Bitcoin’s price do in 2022?

First of all, models have been broken in 2021 and previous patterns have most certainly been invalidated.

Most people thought Bitcoin’s price would at least reach $100k in 2021 and even though most macro indicators were pointing towards this, Bitcoin’s steam ran out in Q2.

The fundamentals are pointing up

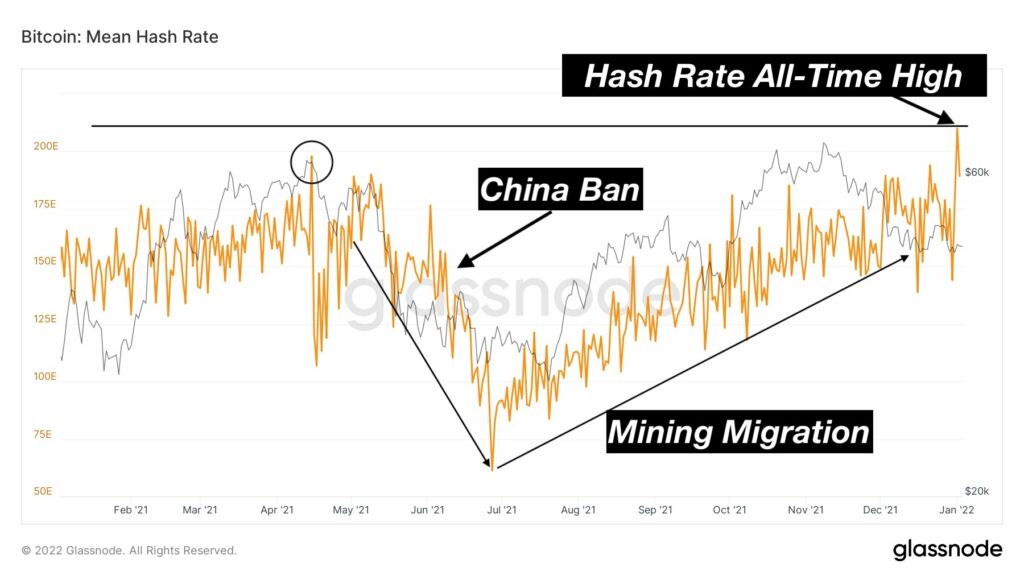

The biggest thing to happen to Bitcoin in 2021, in my opinion, was the Chinese ban that turned out to be an actual ban (or so they think) in their ‘100th’ attempt.

This caused a 50% decrease in hashrate and many miners had to move their infrastructure abroad – with America taking-on an estimated 20% increase in miners.

A fun fact – people are estimating that there is still around 20% of the global hashrate in China. These underground miners are still hard at work, not giving a crap about their government’s mandate.

Today, Bitcoin’s hashrate is back to an all time high:

This only proves to all current and future adopters that this network is one of the most resilient things on this planet.

Tom Emmer, a US Congressman said:

‘Even when 60% of the world’s Bitcoin mining was forced out of China, the network remained reliable. This technology is capable of so much – if we let it.’

I expect hashrate to continue driving the underlying security and resilience of Bitcoin.

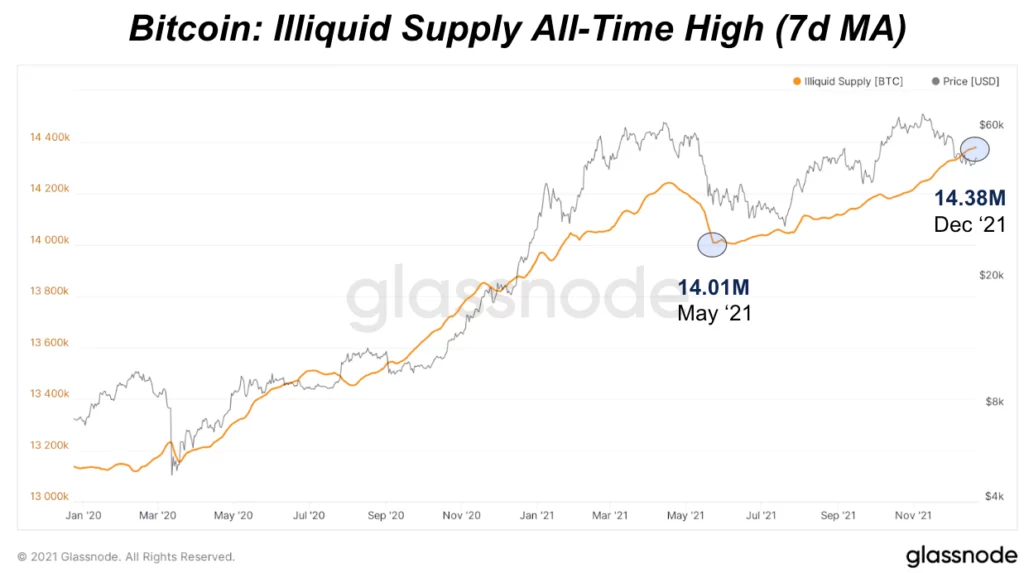

Then let’s look at a 2nd indicator – illiquid supply.

This is essentially how much Bitcoin there is on the market that is determined not to be sold in the short term. These are addresses which tend to hold for the long-term, based on historical data and behaviour.

This is the Bitcoin under the Hodlers’ control:

Currently, 76.13% of Bitcoin is illiquid and is close to an all time high. What this means is that an enormous amount of supply is not willing to sell at this price and if there is any uptake in demand – the price is likely to move on up. Price has tended to follow this indicator, in a lagging manner.

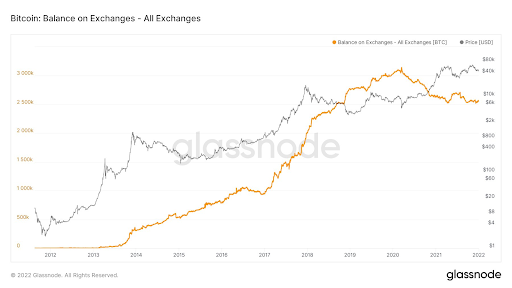

Also, only around 12% of Bitcoin’s supply is on exchanges. This is the lowest it’s been in 3 years. We have seen more and more Bitcoin getting removed from exchanges to cold storage. This is another factor which affects the sell side. And if you were to really think on this, only 12% of Bitcoin is determining the price of it right now.

Lastly, let’s focus on where we are in the ‘cycle’. In the previous 4-year or ‘halving’ cycles, Bitcoin followed similar bull and bear patterns. 2021 completely invalidated this pattern and now we are in completely uncharted territory.

This could be due to a plethora of reasons but I think the three largest factors are:

- The stage of the adoption cycle and the incoming demand from institutional investors. The type of investor in Bitcoin is completely different to previous years. Large institutional investors are joining the fray and their behaviour is completely different to the 2017 retail investor.

- The macro environment and the inability for monetary policy to remain rational. The central banks’ relentless printing over the past 2 years has certainly been a variable in Bitcoin’s price. The question now is will the central banks taper this year?

In my opinion, I think they will attempt to do so. The US Fed will lessen purchases of bonds and this will likely have a considerable effect on stock markets and alike. Bitcoin seems to be quite correlated to stock markets, which confirms its risk-on status.

If the Fed, ECB and others taper this year – expect short-term volatility to the downside. It will be short-term in my opinion. The greed of the financial markets will overcome rationality – as it tends to do. - Lastly, what happens to altcoins, NFTs and other similar assets when the demand-side dries up. Maybe it will happen organically (there are already signs that this may be happening now) or as soon as speculation turns to devastation – as tapering begins.

Whatever happens, these are the ultimate risk-on assets. I won’t be surprised if many of these speculators seek safety in Bitcoin.

There are a lot of possibilities this year and the biggest short-term factor will undoubtedly be what Central Banks decide to do. Dovish or Hawkish – either will drive the price.

In the long-term, however, it doesn’t matter. This is why we implore people to have a long-term perspective on their Bitcoin holdings.

Will a US Spot ETF be authorised?

Another factor will be if a Spot ETF is introduced to the US market. The SEC has been delaying authorisation on these specific ETFs, as they are closely related to offshore Bitcoin exchanges – which are out of their control.

However, Hester Pierce, an SEC Commissioner, stated that she ‘doesn’t understand why a Bitcoin spot ETF hasn’t been approved yet…’

All approved US ETFs thus far have been derivatives-based where contracts are not directly settled in Bitcoin.

As soon as a spot ETF is approved in the US (like they have in Canada and other countries), we could see the demand-side for Bitcoin rise considerably.

Keep your eyes on Grayscale & Van Eck’s applications this year. We will make sure to keep you in the loop.

Will other countries adopt Bitcoin?

El Salvador’s president seems to think so. He expects two more countries to adopt Bitcoin this year.

In my opinion, it could happen but the realist in me thinks that the El Salvador ‘experiment’ needs a little more time to prove the concept. Once they prove that this actually does bank the unbanked (where so many others have tried and failed), there will be a considerable amount of emerging economies that will adopt the Bitcoin standard. These things do take time.

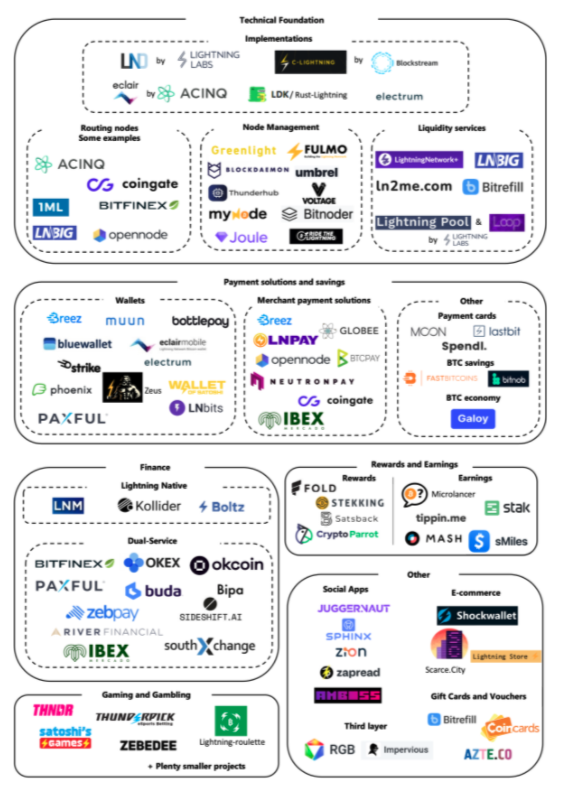

Lightning NetworkI expect the Lightning Network’s capacity and overall adoption to continue its uptrend this year:

And I also expect to see new applications and overall innovation on the network this year.

As more businesses and developers move their focus away from some over promising altcoins, to this network – we will see interesting applications being built around micropayments and even non-financial applications.

Here is the current LN ecosystem. Expect some new names in their respective verticals by year end.

Bitcoin is stronger than ever

Whatever happens this year, socially, fiscally or politically – I have never been more optimistic about something.

There is a lot to worry about in the world right now. All rational people know that something is up and there’s something wrong with the ‘system’.

In the words of Alex Gladstein, ‘Bitcoiners are some of the most hopeful people I have ever met. They believe in a positive future for humanity that is meaningfully better, more free, and more just than today.’

Bitcoin is not about getting rich. It is about creating wealth and protecting it over the long-term. It is about removing oneself from high time preference, debt, over-consumption and the fiat standard. The world is beginning to see it for what it is.

Preston Pysh explains the imbalance between disorder and the insane growth of stock markets worldwide in probably the best thread of 2021.

As Bitcoin adopters put in more time and effort to understanding this asset, we will likely see this asset move from risk-on to risk-off, with a lot of volatility in between.

Sit back, focus on the things that matter, don’t try to time the markets, stack more Sats, have a long-term perspective and enjoy the ride.

Have a great year ahead!