Bitcoin is becoming the norm in a portfolio

Bitcoin has an average growth rate of 200% p.a when priced in USD and there are various factors that have led to this type of growth.

Bitcoin has the factors of Scarcity, Network Effect and Security on its side.

Bitcoin’s supply is currently around 900 new Bitcoin per day, which are rewarded to the miners validating transactions. By 2024, this will be halved to ~450 Bitcoin per day. No matter how many more miners and computing power is added towards mining Bitcoin, this will remain constant – due to the brilliance of the Difficulty Adjustment Algorithm.

In the words of a renowned investor, Ross Stevens: ‘Bitcoin is the first store of value, ever, in which its supply is entirely unaffected by its demand.’

In summary, if the 2017 retail-driven Bitcoin bull market led the price to ~USD 20,000, it is a pretty air-tight hypothesis that an institutionally-driven bull market can lead the price towards something quite significant.

The narrative in the market has been to allocate a small portion of one’s portfolio to Bitcoin and this has only grown in strength recently.

When looking at the security of the asset in an investor’s portfolio – the need for self-custody becomes quite important.

Bitcoin can be held on an exchange, within its wallet. In most cases, it can be withdrawn to other Bitcoin wallets and thus, an investor can move it where they see fit. If they were to move abroad, they could easily move the Bitcoin to a domiciled exchange, keep it there or withdraw it into the relevant currency.

In this case, investors are not holding the underlying value – the private keys. The exchange is. A big question is – what if regulation changes overnight, like it did in Nigeria? What if Bitcoin becomes illegal in a country, due to some Central Banking law? What if an exchange, all of a sudden, does not let an investor withdraw their Bitcoin? This could potentially happen due to internal and external reasons out of an investor’s control.

This is where the importance of self-custody comes into play.

The importance of Self-Custody

Bitcoin as an asset has a different set of requirements and risk-mitigation processes in order to custody it directly.

What does this mean exactly and why is self-custody so important?

Since Bitcoin’s inception in 2009, exchanges have grown into Billion dollar companies worldwide. With the growth, the user experience to purchase Bitcoin has become easier and more secure. When exchanges convert funds into Bitcoin, it is allocated to a Bitcoin wallet on the exchange – in an investor’s name.

What this means is that exchanges are ‘custodying’ Bitcoin on behalf of the investors – where investors have certain rights to exchange or withdraw the Bitcoin to their own wallets. Some services such as Paypal don’t even allow users to withdraw Bitcoin. They would need to convert it back to Fiat money and initiate a withdrawal.

Exchanges are now building services that rehypothecate Bitcoin such as providing interest, loans etc. What this means is that banking services are essentially being built on top of Bitcoin as a collateral.

History shows that rehypothecation leads to balance sheets with assets smaller than liabilities and thus, what is being created is another form of fractional reserves and a similar banking system to what we have now.

Most understand what underlying problems the fractional reserve system created in the first place. If all users decided to withdraw their Bitcoin from these exchanges, what happens when there is not enough to fulfil these withdrawals?

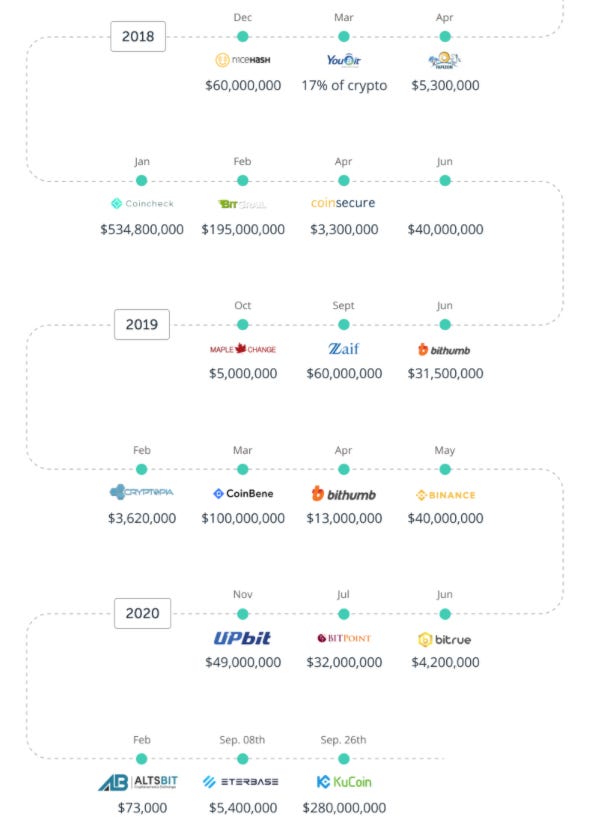

Another key aspect is the amount of exchanges that have been hacked in the past. In 2019 alone, 12 exchanges were hacked, with Billions of Dollars being stolen. With loose regulation around Crypto, a lot of exchanges don’t necessarily need to provide insurance to investors if they were to be hacked.

In summary, Bitcoin as a Store of Value is supposed to be self-custodied, where all counterparty risk is removed. This is Bitvice’s fundamental belief.

The management and security of Investor’s Bitcoin

Bitcoin self-custody is a ‘balancing act between security and ease of use’.

There are countless self-custody solutions available, where the most popular would be hardware wallets – in which the private keys to Bitcoin are held.

The most popular hardware wallets are Ledger or Trezor devices.

These devices are password protected and also have a set of 12-24 words that allow the investor to access their Bitcoin on any other device – if their original device were to be lost.

Setting up a device is easy and there is a plethora of information, tips and techniques to properly secure one’s Bitcoin.

However, it is pretty clear that many investors may struggle to get this information in an effective and secure manner.

That is where financial advisers play an important role. They can be a force that assists clientele to purchase, self-custody and properly secure their Bitcoin.

However, the mandate of an advisor can play an important role in the long-term management of this asset in an investor’s estate.

The complexities and risks around Bitcoin are not only about purchasing it, but also in the continuous management of the asset class.

That is where financial advisors can help the most.

Let’s look through the various use cases in an investor’s journey, alongside their IFA.

Bitcoin and advisory services

Wallet setup

Setting up a self-custody wallet has improved exponentially over the past few years – both in user experience and security.

Bitvice can assist advisors in purchasing and setting-up different types of self-custody wallets for referred investors.

Bitvice also allows advisors and clients to purchase new, untampered hardware wallets through the website, from the sole authorised provider in South Africa – Cryptovault.

Assisting investors to set up self-custody wallets can be a valuable advisory offering.

Purchasing Bitcoin

Purchasing Bitcoin through Bitvice is seamless and secure. More importantly, we provide referral fees to an advisor, paid in Bitcoin. Bitcoin is settled directly to an investor’s pre-confirmed wallet. Bitvice tries to educate all investors on the importance of self-custodying their Bitcoin. Advisors can earn referral fees through Bitvice for doing the same.

Tax and Investment Reporting

Bitvice has exportable reports that confirm the individual Bitcoin purchases, at what time and at what price.

This allows investors and referring advisors to easily determine tax implications (capital gains) if an investor were to sell their Bitcoin down-the-line.

Providing advice around taxable events and how to mitigate these as early as possible, allows investors to understand how to manage Bitcoin over the long-term.

Further security

When an investor holds Bitcoin on their mobile or hardware wallet, in most cases – they need one set of private keys to sign a transaction. In other words, there is one ‘signature’ needed to send Bitcoin out of the address/wallet.

Bitcoin has the inherent ability to allow a multiple set of private keys to sign a transaction. This is called a multi-signatory setup. There are current solutions available that allow users to easily set up multi-sig on their Bitcoin. Bitvice explains this further here.

An interesting use case for advisors, would be to hold one set of keys for an investor in a standard 2-of-3 multi-sig setup. What this means is that there are 3 sets of private keys for a wallet that holds Bitcoin. 2 keys, out of the 3, are needed to sign a transaction.

In this scenario, the investor can hold 2 sets of keys – so they remain independent on their Bitcoin. However, a trusted advisor can hold the third set. The advisor cannot directly access the Bitcoin, as he/she only has one set of keys, where 2 are required. If the investor were to lose a keyset, the advisor has access to one, and can assist the investor to access their Bitcoin.

In this way, the advisor still has a long-term relationship with the investor over this asset.

Bitvice believes this will be an incredible offering for advisors to bring to their clientele.

As stated above, advisors can assist in securing an investor’s private keys and thus, their Bitcoin.

When self-custodying, Bitvice believes that educating investors on the underlying risks is a lengthy and confusing process.

However, Bitvice provides detailed explanatory notes in our Knowledge Base on the complexities of self-custody.

Estate Management

Bitcoin is becoming a large part of investors’ estates as it has grown to a Trillion Dollar asset in marketcap.

What happens to Bitcoin in an investor’s self-custody wallet if they were to pass on? More importantly, how can it be securely transferred to the correct beneficiaries?

These are becoming popular questions and there are various methods to allow executors to pass this asset on to correct beneficiaries.

Multi-signatory setups can be used, and trusted third parties can potentially have access to certain or all private keys.

Bitvice can provide technical input to these questions.

Join our weekly webinars on our Youtube channel, where we answer any questions from financial advisors

Or contact us at connect@bitvice.io if you wish to learn more.

Moving or Selling Bitcoin

If Bitcoin is immediately self-custodied by investors, it can be moved anywhere, anytime at the investor’s whim.

It is important to educate investors on how to securely move their Bitcoin, so to ensure they send to the correct receiving address.

There are other options available to ensure there is always a hands-on approach, to assist investors when the need to move their Bitcoin arises.

This is where multi-signatory setups become a very interesting and valuable advisory service.

If the price of Bitcoin continues its upward trajectory in the current bull market, there will likely come a day that investors wish to sell their Bitcoin.

There are numerous options available for investors to safely sell their Bitcoin, which we explain on our website.

Advisors can assist investors in setting up these wallets and how to place sell orders, before the need arises.

Once again, advisors can also play an important part in determining the tax implications. Bitvice assists with easy-to-export order details, and provides the base price of what the Bitcoin was bought at.

Conclusion

Bitcoin as an asset that will play a more important role in a lot of investors’ portfolios as it continues its adoption curve and price realisation.

It is quite different from other investment vehicles as its ability for self-custody is one of its strongest characteristics.

Yes, Gold can be stored in a safe and effectively self-custodied, but Bitcoin as a digital asset has much more complexity and a requirement for proper management – to ensure investors retain it securely.

Financial advisors are continuing to learn the fundamentals of Bitcoin and Bitvice is here to help them with their educational journey. It is inevitable that Bitcoin will form a part of advisory services and Bitvice wants to be the lead service and Bitcoin provider for all financial advisors in South Africa.

Join Bitvice at www.bitvice.io to learn more about Bitcoin, assist others in setting-up secure wallets and to purchase Bitcoin. Earn up to 3.0% for referred Bitcoin purchases, paid in Bitcoin to your own wallet.

Join our weekly webinars on our Youtube channel, where we answer any questions from financial advisors

Or contact us at connect@bitvice.io if you would like to know more.

The Bitvice Team