Bitcoin versus The Traditional Paradigm

At Bitvice, we have had plenty of discussions with independent financial advisors and direct investors and there have been many questions around the fundamentals of Bitcoin.

Every single discussion has been positive and rewarding for the team, as more and more people are focused on the underlying value and intricacies of Bitcoin – not just the price.

And that is exactly where the discussion should be. Not just the price, but why Bitcoin exists, what it is up against, how to self-custody it, the management of the asset and so on.

Other questions have been about understanding the negative connotations around Bitcoin. Bitcoin is going against not just banks, but Central Banks. This means that it going against the primary powers of this world. Thus, there is quite a lot of ‘FUD’ (Fear, Uncertainty and Doubt) tied to Bitcoin and some criticisms are justified, yet most are easily refuted.

Let’s go through the common arguments against and for Bitcoin.

Governments will kill Bitcoin

Against: Governments will never allow a non-sovereign or state currency to ever evolve into something competitive. Governments and their central banks systemically drive control through their monetary and fiscal policies and so, anything that is out of that framework will automatically be an ‘enemy of the state’.

For: Bitcoin is truly the most decentralised network on this planet with over 100,000 reachable, full-nodes validating the blockchain, every minute, every hour, every day.

Many countries have tried to ban or kill Bitcoin – including China. Every attempt has failed dismally. Recently, the Nigerian Central Bank called for the ban on Bitcoin. Even though a quick and harsh ban came into effect, there has been a 15-20% increase in Nigerian peer-to-peer Bitcoin transactions. As of March 20201 Nigeria’s central bank has officially withdrawn its short ban.

With every ban, Bitcoin has come back stronger and will continue to do so. Especially as institutions such as Microstrategy and Tesla are placing Bitcoin as an asset in their reserves, there is a large and important indirect effect from this – an institutional ‘moat’ is being built around Bitcoin.

These institutions are armed to the teeth with lobbyists who only have Bitcoin as their best interest and will fight any potential ban on Bitcoin.

Lastly, there is the important factor of international arbitrage when it comes to being for or against Bitcoin. Those who ban it will see capital fly to countries who accept Bitcoin and those that have fair tax incentives and structures. There will certainly be governments who will accept Bitcoin and its investors. Those countries who truly understand Jurisdictional Game Theory, will be the ultimate winners.

Bitcoin is a bubble and is too volatile

Against: Bitcoin is a bubble that will eventually ‘pop’. It is driven purely by retail mania and will eventually implode into itself as the marketcap reaches critical mass.

For: Bitcoin has gone through numerous major cycles since its inception in 2009. Every cycle has seen returns greater than 1,000%

Returns like this have been seen in the past in other assets (insert ‘Tulip Mania’) but Bitcoin is completely different to other types of assets. It is fundamentally deflationary in nature, where its supply is completely unaffected by its demand. Due to this inherent characteristic, many proponents have simply explained the high returns are built into the Bitcoin protocol itself.

In the long-term, these types of returns over each cycle is likely to fall – as the adoption curve of Bitcoin slows its exponential curve.

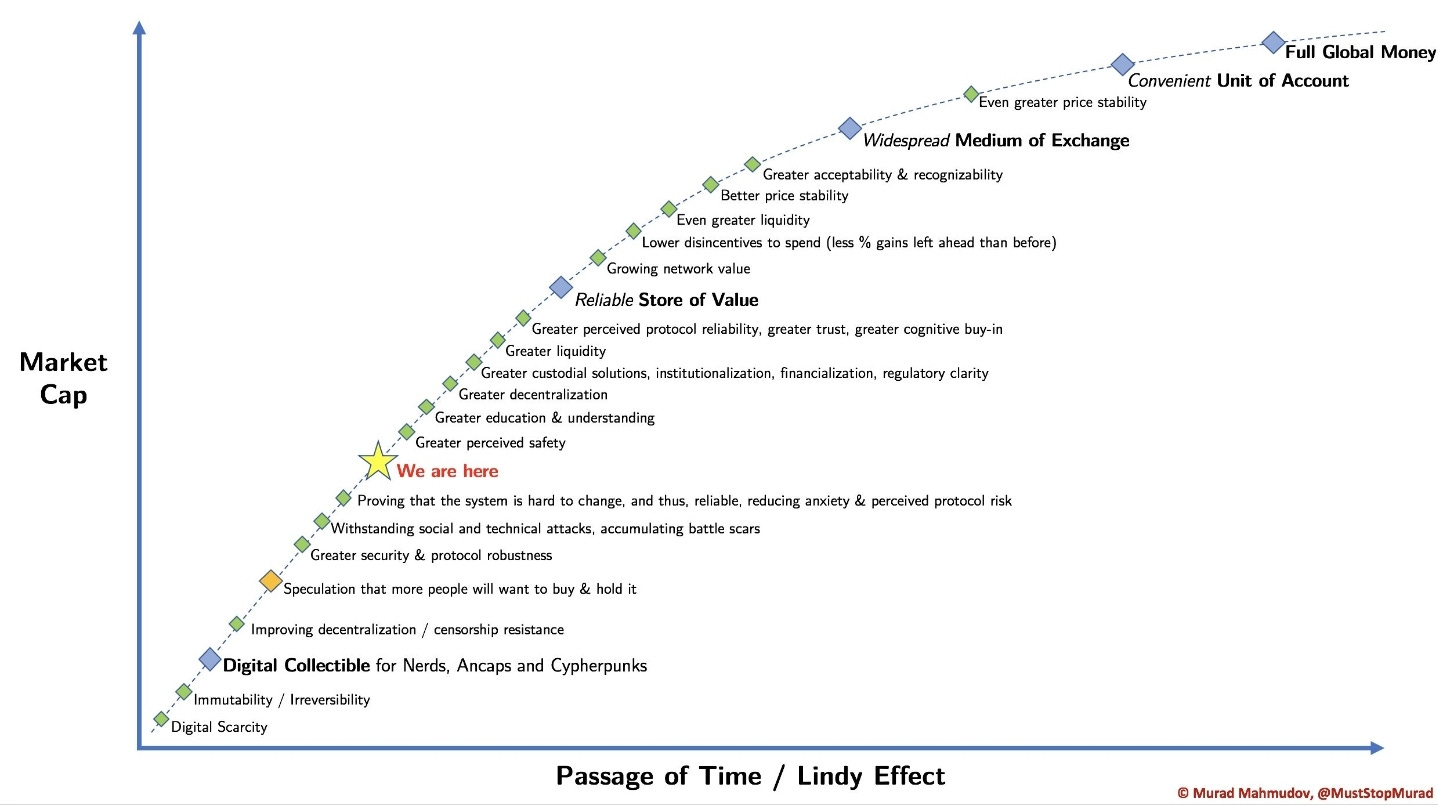

As with any other innovation, it has also moved across an adoption curve based on the Lindy Effect, like the one below:

The Bitcoin adoption curve above was first illustrated in 2018. The ‘We are here’ point has moved upwards somewhat quickly in 20/21 due to a massive milestone – the Institutional adoption of Bitcoin.

If institutions such as Tesla, Microstrategy, Massmutual and other behemoths are choosing to purchase Bitcoin for the long-term, whilst its supply is halved every 4 years; it is prudent to assume that we are not any ‘pin-point’ of a bubble.

Single Bitcoin purchases are at Billions of Dollars now – via large institutions. Bitcoin ETFs are popping up all over the world. This means pension funds will be able to legally invest in Bitcoin.

If the Cryptomania of 2017, driven purely by retail demand with a minute amount of global purchasing power can lead Bitcoin to a price of ~$20,000; what will the massive purchasing power of institutions lead the price to?

Bitcoin has no underlying value

Against: Bitcoin is nothing but a digital asset that is driven by speculative mania. It’s value is driven by a consensus of speculators only and once the buyers dry-up, the price will collapse. Hence, it has no underlying value.

For: It is common practice for traditional investors to look at ‘value investing’ – which is the crux of Warren Buffet’s long-term strategy. However, not all investment strategies fall into ‘value investing’. In certain circumstances, it may be an irrational concept when looking at certain investment vehicles.

Yes, it may work with equity investing and looking at the discount rate on working companies. But, Bitcoin should be closely tied to another type of asset class – Gold.

Gold has a 5,000 year brand to it and the value lies in its scarcity, durability and amount of energy, labour and time it takes to get it out of the ground.

Bitcoin miners need to input an incredible amount of energy to win the block reward and earn Bitcoin.

Bitcoin is scarce, always will be and nothing can change that. There will only be 21million Bitcoin by ~2,140AD.

Bitcoin is durable; its value will never decay.

These are all objectively intrinsic properties to Bitcoin and thus, it is called Gold 2.0.

If Gold has intrinsic or even ‘underlying’ value, then Bitcoin certainly does too.

Bitcoin is dangerous and wastes energy

Against: Bitcoin requires an incredible amount of energy to mine and thus, it hurts the climate and even wastes energy.

For: This is a complex topic and needs to be broken-down into certain points:

- Why does Bitcoin use a lot of energy?

Bitcoin’s energy use is primarily driven by miners all over the world that use specific hardware to solve a complex puzzle – so to earn the right to imprint a block of transactions into the blockchain and earn the Coinbase (miner’s reward) and transaction fees.However, Bitcoin’s high-use of energy is also for:- creating robust security around Bitcoin’s transactions and settlement layers.

- allowing anyone in the world to join the network on an equal footing.

- incentivising against changing current or past transactions, based on the cost of doing so.

- What is wasted energy?

It is energy that was never utilised for some purpose – plain and simple.The latest US statistics show a despicable picture of how ineffective first world countries are at utilising its total energy output:Close to 67.5% of energy that was produced in the US in 2019 – was ‘rejected’ energy and not utilised for some purpose, product or output. - What is the energy Bitcoin uses relatable against, so to determine if it is ‘wasted energy’?

As of Feb 2021, Bitcoin uses less energy than clothes dryers in the US only. This is not relatable energy, it just an interesting point to muse over.When looking at something relatable, let us look once again at Bitcoin’s closest relative; Gold.As of 2020, Gold uses around twice as much energy as Bitcoin when simply looking at mining and production. Bear in mind, this does not take into account the energy Gold uses to store, secure and transport it globally.

If Bitcoin uses half the energy of Gold to secure a Trillion Dollar asset, where storage costs are insignificant – would it seem like wasted energy? - Where is Bitcoin’s energy use now and where is it going, based on incentives

To stay competitive, bitcoin miners must seek out abundant and inexpensive forms of energy. And there’s no energy source more abundant or affordable than green energy, meaning that any miner who wants to profit—whether they care about the environment or not—has to help squash bitcoin’s carbon footprint. Far out, man. – BitcoinMythology.orgAs of 2021, 40% of the energy used for Bitcoin’s network is renewable energy. This has grown exponentially alongside improvements to mining hardware so to diminish cost of mining.

Even in China, where most of the hashing power lies, around 80% of the energy used to mine Bitcoin is green energy (mostly hydro).This will only increase over time, as the hash power (amount of miners on the network increase) due to competition for the reward at a higher USD price.Lastly, there have been incredible advances in Bitcoin’s protocol, especially its second-layer; The Lightning Network.What this means is that the second layer can be used for millions of payments per second, whilst large settlements will take place on the first-layer; due to high transaction fees and the inherently-slow abilities of its blockchain.The second-layer will use much less energy than its parent layer; and so this debunks the myth of ‘high energy for high transactions’ as the adoption curve grows. - How has Bitcoin changed energy?

Most energy is wasted due to its incapability of being transferred effectively over distance and time.Bitcoin is the first of its kind to effectively turn energy at its source into a monetary good. Once transmuted into a monetary asset (Bitcoin), it can be moved across space and time at free will.Energy can effectively be stored into a durable asset that lasts forever. This allows people to distribute themselves and not need to congregate close to energy sources.This is a massive problem that Bitcoin is currently solving.

Bitcoin is an anonymous network that is utilised by criminals

Against: Bitcoin is an anonymous network that is used by criminals to sell illegal goods and to launder money.

For: First of all, Bitcoin is not an anonymous network. It is far from that. It is an open, transparent ledger that has recorded all transactions to and from addresses since its inception.

With on-chain analysis, it is quite simple to determine the flow of funds and the senders & receivers.

Thus, only around 1% of Bitcoin’s transactions have and are used for illicit activities. When compared to physical cash, the amount of criminal users on Bitcoin’s network are insignificant.

Bitcoin will be hacked and everyone will lose trust in it

Against: There is always news that Bitcoin has been hacked and so it is not trustworthy.

For: Bitcoin, the protocol, has actually never been hacked. Due the amount of nodes validating and securing the network, its open-source code base and inherent characteristics – it is fundamentally impossible to hack/change its blockchain.

The hacks have occurred on central points of failure – exchanges that hold Bitcoin on behalf of others. This is where Bitcoin has been stolen in the past and present, and will continue to be so in the future.

That is why it is so important to self-custody one’s Bitcoin. Not your keys, not your coins.

Ethereum will kill Bitcoin

Against: Ethereum is a better form of Cryptocurrency. It allows for more complexity, security, overall development and so it will bring about Bitcoin’s downfall.

For: This is a contentious topic and has created differing ‘tribes’ in Crypto communities.

When looking at some of the first principles of Bitcoin, decentralization and irrevocability – Bitcoin is far ahead of Ethereum.

There are over 100,000 Bitcoin full-nodes distributed globally that are currently validating and securing the network. These are self-sovereign nodes that are hosted directly on hardware.

Ethereum only has around 8,000 full-nodes, however, around 60% of these are hosted in the cloud (AWS etc.) This is where decentralisation plays a key part… What if AWS decided to close their services to Ethereum?

When looking at irrevocability, Bitcoin is completely lost if used or sent incorrectly. Due to its central powers, Ethereum decided to roll-back its blockchain when a massive hack occurred in 2016. If this actually occurred, can Ethereum actually market itself as a ‘decentralised’ Cryptocurrency?

These are all important points that argue for Bitcoin’s use case: to be completely decentralised through +100,000 full-nodes, have no irrevocability, no central point of power or authority and to become the world’s reserve currency.

But what about smart contracts and transaction speed?

Bitcoin’s second-layer has had many recent developments that allow smart contracts to be built into transactions such as time-lock functions etc. These currently are and will continue to be relatively competitive to Ethereum’s value proposition; yet it is on a more robust and secure network.

The Bitcoin second-layer also allows for millions of transactions per second and this will continue to improve over time. Effectively, this makes Ethereum and thousands of other cryptocurrencies redundant.

We believe in the term, ‘Bitcoin, not Blockchain’. When taking into consideration The Network Effect, Game Theory and The Schelling Point there is no need for thousands of Blockchains.

There is only need for one, Bitcoin.