At Bitvice, we stress the importance of Bitcoin self-custody. But with great power comes great responsibility and Bitcoin is an asset that demands extreme ownership. This article will cover some of the most important aspects of holding your own private keys to ensure that you don’t lose access to your Sats through some of the most common vectors, including theft and your own incompetence.

If you have decided to don the mantle of responsibility that comes with holding your own Bitcoin, I applaud you. It is a vital step in the direction of self-sovereignty and implies that nobody can limit your access to your own money, regardless of how powerful they are. Bitcoin was designed exactly for this method of ownership. Self-custody brings the promise of freedom, but requires that you take extreme ownership of the assets under your control. Nobody can save your coins should you lose your private keys and thus it is vital that you take adequate precautions to ensure that they are securely stored.

The largest risk that you face with self-custody is yourself. You could make a mistake in how or where you store your private keys, thereby granting access to those who should not have access, or losing access yourself by not securing them in a robust enough manner. Furthermore, you could make your storage solution too complex and in effect lock yourself out of your own money. This is a particularly depressing position to put yourself in.

The second risk (particularly in South Africa) is that of the $5 wrench attack. Basically, this is somebody knowing that you have Bitcoin, so they threaten to hit you over the head with a $5 wrench if you don’t give them your private keys. This can be relatively easily defended against, primarily through good operational security (opsec), by using a multisig wallet as well as good personal security.

However, your primary starting point for any type of self-custody should always be securing your private keys. In plain english, this means writing down the 12 or 24 words that your wallet generates for you upon setup. This could be a mobile wallet on your phone or a hardware wallet. This part is vital. It is essentially a backup of your wallet. Should your phone or hardware get stolen or lost you can always import these private keys into a new wallet and regain access to your Bitcoin. It is vital that you keep these private keys separate from where you store your wallet (hardware wallet or mobile wallet) since you do not want them to be stolen or destroyed at the same time, as this will mean you lose access to your Bitcoin. A very good rule of thumb is to store your private keys in a separate geographic location to your wallets.

As mentioned above, there are two primary risks with self-custody that you face:

- Yourself

- Other people

Let’s address the first risk first. How to protect yourself against yourself. This can be broken down into the following key areas:

A. Storage risk

B. Complexity risk

A. Storage risk

This type of risk comes with storing your private keys. For example, should you store your private keys in your home, alongside your hardware wallet, then you are running the risk of simultaneous destruction of both your wallet and private keys in the event of a fire. You are also running the risk of losing physical access to both at the same time (you are forced to flee your home country and can never return, ala Afghanistan 2021). A good way to offset this risk is to keep your private keys in one secure location and your hardware wallet in another. That way you can access your hardware wallet for whenever you need to perform a transaction, but have your backup (private keys) stored elsewhere.

Bear in mind that storing your private keys elsewhere could mean that other people have access to your private keys. If they manage to acquire them, then they will be able to access all of your Bitcoin that is controlled by your wallet. This is a very bad scenario and can result in a total loss of funds for you. As such you must ensure that your private keys are stored both elsewhere to your wallet and outside the control and/or view of other people. A way to offset this risk is by storing your private keys in a safety deposit box with a bank. But this is not 100% secure, as safety deposit boxes have been known to be raided by the police and can revoke access to you if you don’t pay your subscription fees.

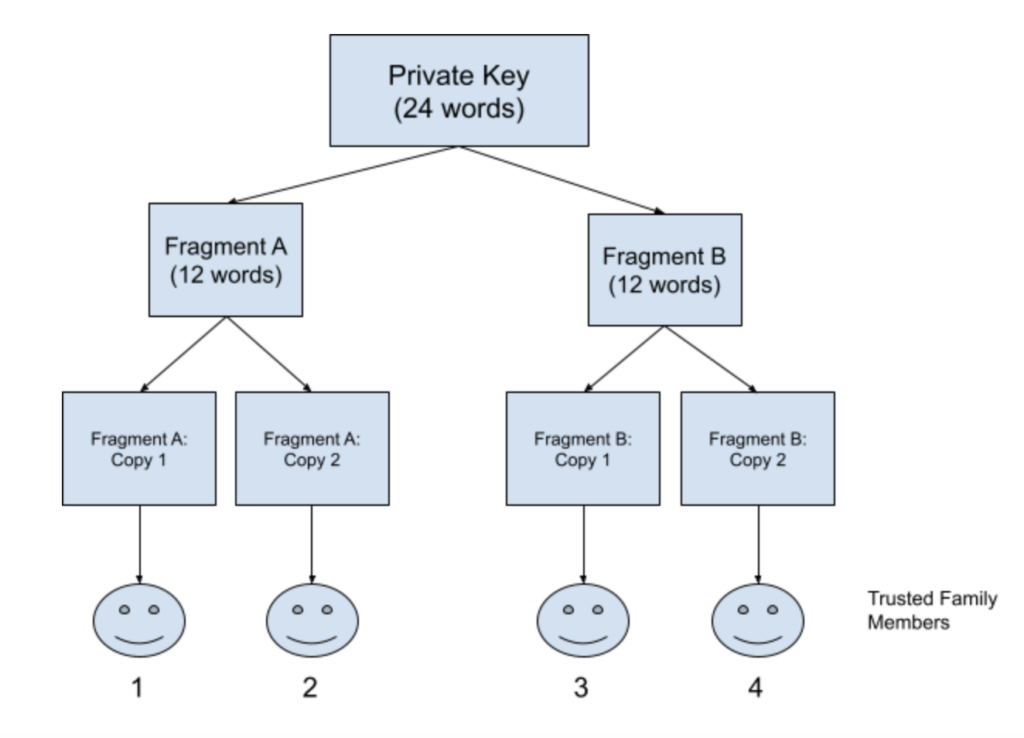

An alternative arrangement involving semi-trusted 3rd parties could be done as follows: Split your private key into 2 parts, while duplicating each part (to a total of 4 fragments, each representing 50% of your private keys) and leaving those in the safe keeping of a trusted family member (or other trusted third party). That way the individual holding a private key fragment is unable to access your Bitcoin and needs to cooperate with another individual who is holding the other fragment of your private key in order to gain access to your Bitcoin. The duplication allows for 2 of these trusted members to lose their fragment without you losing the entire private key, as the other members can still be relied upon to return their fragments. However if both trusted members holding fragment A were to lose their fragments, you would lose your backup. The same applies to both holding fragment B. Thus it is important to conduct regular security spot checks to ensure that your fragments are still securely held. If any party loses control over a key fragment you can generate a new wallet via your hardware wallet and thus generate a new set of private keys. You can then redistribute the new fragments.

B. Complexity risk

As I said earlier, the biggest risk to your Bitcoin is yourself. While you may be able to come up with complex and convoluted security solutions to ensure that nobody has access to your Bitcoin, you could end up locking yourself out of your wallet if any of the critical steps in your plan go awry. If you are not yet that proficient with the ins and outs of self-custody, it’s probably best to keep things simple. The solution of fragmentation that I’ve outlined above is fairly simple, but can still be gamed against you. For example two family members may conspire to steal your Bitcoin. Thus you can offset this risk by not informing the other private key fragment guardians about the identity of the other guardians. Or you could leave one fragment with the family lawyer, financial advisor or trusted religious figure. This is completely up to you. But keep it simple! Your plan needs to be such that in the event of your death, your will should be able to explain how to access your Bitcoin to your dependents. After all, what is the point of wealth if you can’t pass it on?

Protecting your Bitcoin against other people

We have already discussed the risk posed by somebody else having access to your private keys. Don’t leave your private keys lying around or give them to anybody else in their entirety and you can offset a lot of this risk.

However, the $5 wrench attack is real. Particularly in South Africa, where violent crime is a reality. I would imagine that Bitcoin specific crimes are going to increase over the coming years as criminals realise that showing up to somebody’s house with a gun is as an effective method of wealth transfer as it’s ever been.

- Don’t talk about your Bitcoin

The first way to guard against this is simply not to tell people that you have Bitcoin. Keep a low profile, Bitcoin may hit $1 000 000 a coin at some point in the future and you could find yourself a lot more wealthy than you were before. You may become a target.

Secondly, if you talk to your friends about Bitcoin, they often ask how much you have. Never answer this question. Nobody needs to know how much Bitcoin you have. It’s both rude and dangerous.

If you follow these two rules you can offset a lot of the risk. However, taking some physical precautions are the next tools in your arsenal.

- Get a multisig wallet

Multisigs are more complex, this is true. If you are a relatively new user you can cause yourself a lot of grief by not setting up your multisig correctly or storing your coordination file incorrectly. However, a multisig gives you the option to geographically distribute your hardware wallets. This means that if anyone shows up to your house to rob you, they would have to kidnap you and move you under duress to another location in order to force you to sign a second key and potentially move your funds to the address of the criminal. This is exponentially more risky for the criminal, particularly if your second hardware wallet is in a public/secure location such as a safety deposit box.

This makes multisig wallets exponentially safer than a hardware wallet, from a physical attack perspective. A multisig also allows you redundancy in your wallet setup, meaning that you can lose access to one of your keys and still rely on the others to move your Bitcoin. Think of it as a Swiss bank vault that has 3 keys to open it, but only relies on any 2 to unlock the vault door. You can lose one key and still access your money.

If you are interested in a multisig wallet and would like guidance on how to set one up, contact Bitvice and we will guide you through the process.

- Hide your hardware wallet in a non-obvious place

Crime in South Africa is often opportunistic, thus it may be that if somebody breaks into your house they are unaware that you own Bitcoin. Keeping your hardware wallet in your safe with your other valuables is a dead giveaway. I suggest finding a hiding place that is somewhere robbers will never naturally look for valuables.

If you follow the suggestions detailed in this article you will place yourself in a position where you have stored your private keys on a secure device, such as a hardware wallet, and made distributed copies of your private keys for backup purposes while ensuring that no unauthorized parties have access to them. You can then build layers of additional security around these actions, creating a highly secure self-custody environment. This article should serve merely as a starting point to get you thinking about the realities of self custody. This rabbit hole is deep, but when you become your own bank this is to be expected. Have fun with it, keep it simple and keep stacking Sats!

Taking control of your Bitcoin in a self-custodial manner requires some responsibility on your side. I feel that the trade off is worth it. Freedom comes at a price.