It’s been a crazy week in the news and there’s a lot of misinformation going around. There’s still too much fog to determine the socio-political effects of what has transpired in Ukraine in the last week.

As the world awakened to a war on the Eastern front, there was an enormous amount of uncertainty.

In a world of uncertainty, cash is always king (except when there’s a new king in town of course).

It seems like everyone has moved on from the previous crisis to a new one, and all of a sudden everyone is a geo-political expert.

Well, I would like to say I’m not an expert at anything. I just follow the money.

As I’ve said to others, one should follow the money to try and see what’s really happening.

Let’s look at what is happening with the Russian market, the USD, SWIFT and the traditional monetary mechanisms which have theoretically brought Russian to its knees. Or have they?

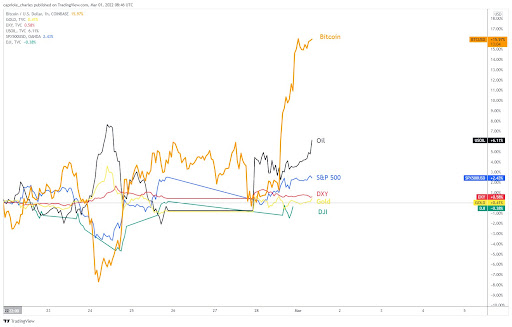

Bitcoin’s week kicked off well with a 20% increase in price and a recent dip. Who would have thought a ‘stable’ $40k price would feel like a rollercoaster?

When Putin invaded Ukraine, there was a mass sell-off on all risk-on assets worldwide. Asian markets kicked off with a slight implosion and American markets were in sync later that day.

Bitcoin moved down in price of course, as expected by most. However, as the West implemented a plethora of sanctions against Russia through monetary measures (SWIFT sanctions etc.) there was a sudden bank run across Russia as the populace feared their funds would become useless or at worst, frozen.

At this point, I think most of us can gauge the absolute fear that Ukrainians are facing in a horrific invasion.

What we don’t see in the news very much are the millions of Russians, and what they’re facing due to their government’s erratic behavior.

For the Russians, they were introduced to the reality of a financial system that has been weaponized through technology, by the few.

It took only a matter of days for the politicians, regulators and centralised operators to remove a large swathe of the Russian population from normal payment rails.

There have been massive bank runs across Russia, as people realised their cards wouldn’t work anymore. What could? Cash.

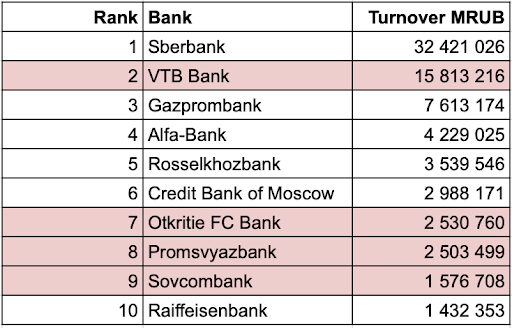

Funnily enough, only 4 Russian banks have been removed from the SWIFT system so far, based on the latest data.

Now, why would this be the case? Why wouldn’t there be a blanket ban on all Russian banks?

Well, it’s likely due to:

Oil and Gas

“Europe produces 3.6M barrels of oil a day & uses 15M. Europe produces 230B cubic meters of gas/year & uses 560B. Russia produces 11M barrels of oil/day & uses 3.4M. Russia produces 700B cubic meters of gas/year & uses 400B.” – Michael Shellenberger

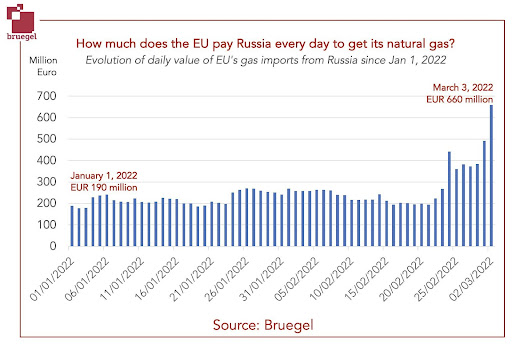

Currently, the European Union receives 40% of its natural gas from Russia.

The EU was on average, paying $220 Million per day for Russian gas. After the recent invasion, this has increased to $660 Million.

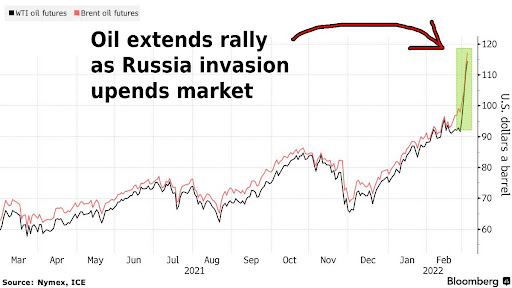

Thanks to the invasion, the sanctions and a lot of uncertainty, oil has put on quite a show. It is up more than 70% this month alone.

And if you have been following the energy markets in Europe over the past few years, you would have noticed numerous nuclear plants have been shut down, as well as natural gas infrastructure. Whether you agree or disagree with the green energy movement that has scaled enormously over the past decade, it has left Europe in the dust – and in a tough position.

Germany took some time to approve the recent sanctions. Thanks to them shutting down numerous nuclear plants – it’s pretty easy to guess why.

Europe needs Russia right now – it’s that simple.

And don’t forget – the US is still buying 600,000 barrels of oils from Russia per day.

Taking this all into consideration – how would Russia be able to sell their exports if they had no means to be reimbursed?

Over the next few weeks, we need to focus on Russia’s exports and who is buying it. This will determine whether Russia is actually getting punished or not.

The US Dollar

Let’s not forget the Petrodollar in all of this. Thanks to this little guy, there have been relentless wars from North Africa to the Middle East over the past few decades.

By ‘removing’ Russia from the SWIFT system, which is a network that settles 37 million financial transactions per day through +11,000 connected banks and organizations – there would be quite a lot of loss in volume. Thereby, bringing down demand for the largest unit of settlement – the USD.

This is only a small piece of the puzzle though.

Russia and its allies have been preparing for this scenario for a while. The volume of Russia’s trade in USD has decreased by more than 50% since 2014.

China, Russia and India have all recently signed bi-directional trade agreements to settle in Euros, and their domestic currencies. Other countries such as Iran, Venezuela, Turkey etc. are also looking to do the same.

When Gaddafi tried to sell his oil for Euros, he ended up beaten to death. It seems that people can only be scared for so long.

Remember one important thing in all of this. The US exports debt, through the petrodollar system. They migrated most of their production to Asia for cheap labour and because most of the world settles in USD, they have the ability to sell an enormous amount of treasuries.

Right now, we are watching this credit card, Dollar empire fall apart on three fronts.

- Treasury yields are standing at laughable rates, driving less demand for US debt.

- The circumvention of the US Dollar banking and settlement networks by factories of the world

- And, most importantly, the increased distrust in the traditional system.

The average citizen from Canada, Zimbabwe, Venezuela and Russia – has faced frozen bank accounts.

And a very dangerous precedent has just been set with $640 Billion in Russian foreign reserves being frozen by Western central banks.

It’s not about whether this is the right or wrong thing to do.

It is about the long term implications of this enactment. Would nations such as China, Turkey and others ever trust foreign custodians again? Foreign reserves are normally denominated in USD.

Where does Bitcoin fit into all of this?

Firstly, if the USD goes down, then Bitcoin’s price goes up in USD.

Secondly, there has been a massive increase in Bitcoin demand in Russia and Ukraine. Thanks to the failure of traditional networks. More and more people are moving their savings to a vehicle that cannot be stopped, nor confiscated.

And lastly, as the globalised world moves away from the standard unit to settle with, there will be massive issues in settling with one another in different units of account. The USD has fulfilled this role for quite some time. Countries will inevitably need an interoperable standard to work with.

They will try to work with new, fiat-based, digital currencies, which they still control but this will probably lead to imbalances, inefficiencies and a number of disputes. Only time will tell.

Perhaps they need something that is not owned by a single country, transparent, liquid, available 24 hours a day, fast, seamless, immutable and settles immediately?

As the Plutocrats fight one another and try to keep the fiat system in place, Bitcoin has just reached a new record.

76.5% of Bitcoin has not moved in 6 months, which is the highest on record ever. Taking into consideration that more than 30% of the supply was bought in the recent bull market, from old hands to new – more and more people are beginning to understand this thing for what it is.

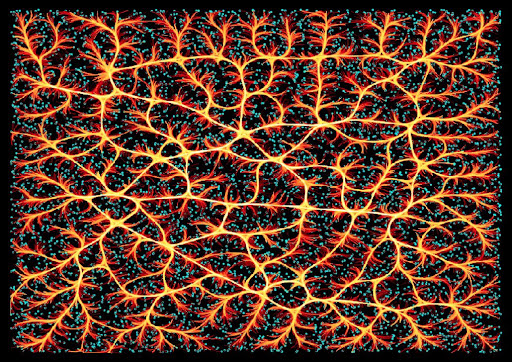

The Lightning Network is also booming

The network currently sits at 16,000 public nodes with 140,000 open channels.

3,450 Bitcoin ($150m) in liquidity is driving the network and there is more talk of nation states such as Mexico welcoming Bitcoin as legal tender. I hope the rumors come true.

What is true, is that we just saw the Swiss city of Lugano accept Bitcoin as legal tender. This is a city right in the heart of Europe.

Gradually then suddenly. One step at a time.

Bitvice Media

Ricki chatted with Jaryd and Rob from The Knowledge Trust, an alternative education structure which utilizes a platform of educational content that helps educate thousands of their members. Furthermore, the platform pairs employers with employees, ensuring that those educated through the platform have great future opportunities.

Rob is also an extremely successful businessman who is deeply passionate about Bitcoin.

By The Horns is a Bitcoin podcast from a South African perspective. You can follow our discussions via video on YouTube or via the audio version on Spotify, Google Podcasts or Apple Podcasts. If you are listening on a different podcast app, here is our RSS feed. Our episodes are also newly available on Breez and Rumble.

I do hope you have a listen to the latest pod with Jaryd and Rob.

Rob explains that ‘there has never been an asset, ever, that anyone can take away from you.’ In a world full of uncertainty, where we do not know what happens next – I think it is vital to have at least a little bit of Bitcoin, to hedge against those who can take so easily.

Some people may say, Ethereum and other cryptos can do the same thing.

Well, no, they can’t.

Metamask and Infura – where most of Ethereum’s underlying operability lies – just blocked Venezuelans from accessing it. This is because of local regulation. What stops Russia from enforcing this as well?

These centralised, premined, deceptive networks are just another form of fiat money. They are controllable by the few and will continue to be so.

They are not a hedge against hegemony. There is only one tool for that – Bitcoin.

In a world gone dark, thank goodness there is something that shines a little bright with hope.