As a new kinetic war rages in the East, Bitcoin is suddenly becoming a kingmaker amongst squabbling nation states.

This is what Bitcoiners theorized as far back as its conception. Things are becoming serious now and this asset is simply so far apart from other speculative cryptocurrencies.

Russia’s representatives have announced their intention to accept it for trade and to begin implementing regulation. Janet Yellen seems to have capitulated on crypto and has also stated intention to ‘…come out eventually with recommendations that will create a regulatory environment for innovation.’

Things are happening more quickly than I ever thought possible. Let’s take another look at Russia again, since it seems to be the most important battleground for the future of money.

Before that, let’s take a gander at the other news:

Exonn Mobile becomes another Bitcoiner

One of the world’s largest oil producers confirmed yesterday that they have begun mining Bitcoin.

The ESG’ers are probably busy going mental about this and continuing their negative narrative on Bitcoin’s energy use.

However, when looking at this with a completely objective lense – Exonn is actually helping the environment.

“The pilot project, which launched in January 2021 and expanded in July, uses up 18 million cubic feet of gas per month that would have otherwise been burned off — or flared — because there aren’t enough pipelines. “ – Bloomberg

We will discuss the geopolitical landscape a little further on, but bear in mind that if this pilot becomes a success (which is very probable as proof of concepts have already been executed many times over) Exonn will then have Bitcoin in its reserves. They will then implement systems and processes to manage payments in Bitcoin and undoubtedly build systems to begin accepting Bitcoin as payment for oil.

Nation states are beginning to accept Bitcoin for trade. Massive companies are doing the same. There’s simply a wonderful pattern emerging here.

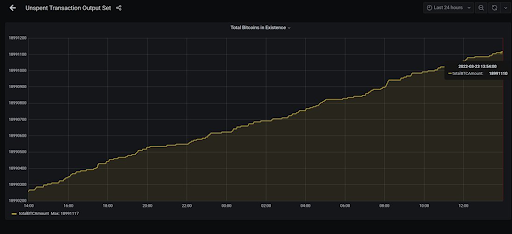

The 19 Millionth Bitcoin will be mined this week

We are about to see the 19 millionth Bitcoin enter circulation sometime in the next week. And there’s only another 2 million to go, by the decade ~2140 AD, based on the supply and halving schedule.

19 million Bitcoin in supply. 2 million left. 21 million Bitcoin only. And 56 Millionaires worldwide.

In the words of Greg Foss, ‘it’s just math’.

What’s happening at the Fed

And my favourite topic of the week – what’s going on with the central planners?

Recently, as expected, Powell and his posse raised rates by .25 basis points to fight aggressive inflation across the US.

The next Fed meeting is not until May and currently they intend to raise rates further.

So, in the past 2 years – around 80% of the US Dollar supply has been printed and all that has happened since then is a laughable 0.25bp raise in an environment where hundreds of millions of people are facing 40-year high inflation.

Most people would say, but this is all they can really do without collapsing the market.

Sure, they may be right but in the last 2 months, they have done nothing but expand their balance sheet to all time highs whilst they’ve stated over and over again – their intention to taper.

Quite frankly, they have done absolutely nothing to stave off inflation. And in California, the 5th largest economy in the world, Dem. Gavin Newson has brought a plethora of quantitative easing measures – further expanding the federal balance sheet.

With oil going a bit crazy there are two paths from here. Further inflation and further demise of the poor.

Or inflationary highs have peaked and we’re about to embark into a deplorable time of stagflation.

It is simply a world trying to stop its trajectory towards utter ludicrousness and back to some form of normality.

Russia and Bitcoin – what’s going on?

As explained in previous newsletters, the repercussions from the US and Western allies freezing Russian foreign reserves, are causing quick, successive implications in the world financial order.

In the past few days, Russia has confirmed their intention to begin selling their natural resources in Roubles and other ‘friendly’ currencies.

Due to this, the IMF has just released a warning that other nation states may dissolve their US reserves, further weakening the Dollar’s power over the global economy.

India has just bought oil at a discount from Russia, and did not settle in USD. South Africa might just do the same – don’t be surprised.

Europe is an energy disaster at this point. The amount of gas and oil they import from Russia is greater than what the entire union produces. Russia has them by the balls – and the media refuse to acknowledge this.

Even though the US has banned Russian oil imports, it’s extremely unlikely that Europe would do the same. They will continue to buy natural resources from Russia, they have no choice. But Russia (and China) want to settle in other currencies.

But there is a problem changing units of account in trade, from a system that has been around for 50 years – where the mechanics and operations are around the Dollar.

So, with all of this happening, Russia’s chairman of its Congressional energy committee, Pavel Zavalny, just announced last week that Russia is open to accepting gold, ‘friendly currencies’ and Bitcoin for its natural resources, beginning with natural gas.

The statement was pointed towards friendly nations such as China or Turkey. More externalised nations will be able to pay in Yuan or Roubles. But Russia is willing to further their scope of payments with friendlier nations – such as gold or Bitcoin.

Zavalny said, “When it comes to our ‘friendly’ countries, like China or Turkey, which don’t pressure us, then we have been offering them for a while to switch payments to national currencies, like rubles and yuan…”

He also continued to say, “With Turkey, it can be lira and rubles. So there can be a variety of currencies, and that’s a standard practice. If they want Bitcoin, we will trade in Bitcoin.”

Now, let’s pause here for a second and reminisce. Not long ago, Putin once said, “I believe that it has value,” when referring to Bitcoin. “But I don’t believe it can be used in the oil trade.” Putin said this less than a year ago.

So, it looks like Russia would be happiest to receive Roubles or Yuan for their oil. Second, they would be very happy to accept gold.

But, on the back of all of this, the US Treasury has also announced that gold-related transactions involving Russia may be sanctionable under U.S Authorities. They intend to implement further restrictions on Russian reserves and trade abilities.

And so, that is probably why there is a sudden turnaround by Russia. They are beginning to understand the true nature of Bitcoin as a non-confiscatable digital gold. The Russian energy minister even confirmed that regulation for Bitcoin mining is needed ‘as soon as possible’. If this is the case and Russia starts to use Bitcoin for trade as well as begins to mine it – we can expect a barrage of negativity towards Bitcoin.

Expect Western Media to demonize it, as they do with anything Russia does. If you intend to hold Bitcoin for the long term, your conviction will undoubtedly be tested.

As Russia continues its adoption, expect them to make mistakes and tinker with other crypto – as they continue their evolution towards their own CBDC and/or sovereign digital token. This will also test the patience of Bitcoin holders.

And of course, we need to look at the Dollar.

This is very, very bad for the Dollar and the middlemen/brokers who hold the petrodollar system in place.

Remember, before 1971, the US Dollar’s system of trust was based on gold. Since then, its basis of trust has been on oil. Now that this is collapsing, what happens next?

With China’s recent ban on Bitcoin mining – I am not too sure about how they would accept Bitcoin as a unit to trade with. They would most certainly want trade done in the Yuan. But there are underlying nuances to all of this. If the Yuan is used, it would drive demand and therefore, the price of the Yuan. China has been manipulating their currency for decades, to keep it low and drive exports as much as possible.

So on one side, they want the petrodollar system destroyed. They want America to not be able to export treasuries. In other words – they want America to finally feel some pain for its debt. But on the other hand, China doesn’t want a too strong Yuan.

It’s complicated and a lot of things are happening in an imbalanced world with an irrational money structure. There is a lot of uncertainty out there.

And uncertainty, to me, is the ultimate advantage for Bitcoin.

Entrepreneurs will continue to try and build thousands of other cryptos, better than Bitcoin. Nation states will continue to battle for their fiat currency to be at the top. Irrationality and chaos will reign supreme.

In the 2008 financial crisis, Bitcoin was something that was borne from chaos and into further chaos, it shall evolve.

We are still very early. Enjoy that for what it is.