Weekly News

The last few weeks have been a whirlwind of activity in the Bitcoin space. Senators in the US have tabled a new infrastructure bill, which contains some details about the regulation of cryptocurrencies, pro-Bitcoin lawmakers have published an amendment to this bill, seeking to clarify some sections relating to Bitcoin. Since the adoption of Bitcoin as legal tender in El Salvador, the capacity of the Lightning Network has continued to grow rapidly, up 46% in two months. Has Bitcoin price action found a bottom? BTC has climbed back above $45k, can we see a return to above $60k?

Some of the other news items for the week are:

1. US infrastructure bill

Over the past few weeks, much fanfare has been made about the new $1 Trillion US infrastructure bill that has been written and is currently collecting amendments from various interested parties. It is important to note that this is separate from the $3.5 Trillion climate change/social safety net bill that the democrats are unilaterally pushing through the senate.

Amendments to the infrastructure bill have been submitted by senators Toomey and Lumis, to provide what they call a more balanced and nuanced view towards the regulation of Bitcoin entities. The key points of the amendment are to not over regulate non-economic actors in the Bitcoin network, such as developers and node operators. The initial wording of the bill would apply sweeping regulations to the above-mentioned actors, forcing them to report and comply with onerous regulation, despite not playing a role in the selling or trading of Bitcoin. What is clear, is that the initial drafters of the bill are intent on bringing the crypto industry under their control, and have been working hard to drum up support for it by painting the industry as that of being dominated by criminals. Senator Elizabeth Warren recently sent a letter to treasury secretary Jannet Yellen asking her to regulate cryptocurrencies with a heavy hand. She claims that the crypto industry is a threat to financial stability, claiming: “Instead of leaving our financial system at the whims of giant banks, crypto puts the system at the whims of some shadowy, faceless group of super-coders and miners, which doesn’t sound better to me.”

It is important to know exactly what Bitcoin is seeking to achieve, before you wonder why some politicians respond to it so violently. Bitcoin is here to destroy central banking and the massive fraud that comes with it. Many politicians are bought and paid for by the banking industry (who are private shareholders in central banks). It should thus be expected that some politicians will be out to do their masters bidding and attack Bitcoin in any way they can. This includes regulation, but will also include reputational attacks in the media and vast amounts of FUD (Fear, Uncertainty and Doubt). The game is only getting started, buckle up. Bitcoin was designed to battle this.

Read more about the bill and amendment here.

2. Lightning network capacity grows

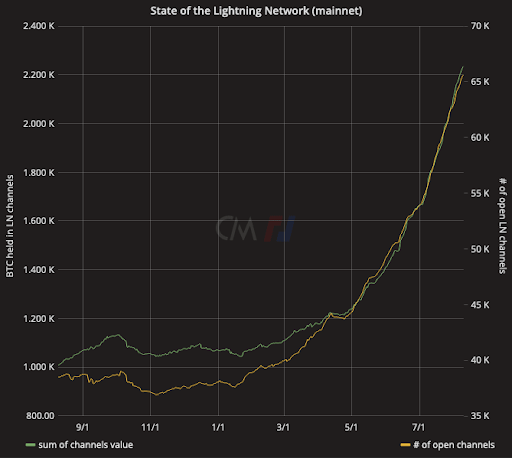

The Lightning Network is shaping up to be the scaling solution for Bitcoin that it was envisioned to be. Lightning, is a second layer built on top of Bitcoin that allows for fast and cheap transactions taking place off-chain. Since the start of the year, the total capacity of the Lightning network has grown by approximately double (from ~1100 BTC to 2200 BTC), with around 46% growth taking place in the past two months.

This rapid growth could be caused by the adoption of Bitcoin as legal tender in El Salvador, where the majority of transactions are taking place off-chain due to their small financial value. However, Lightning is currently facing headwinds, as on-chain fees have been low since the China mining exodus. This is most likely a temporary situation though, as on-chain fees tend to rise, following network traffic and as price moves to the upside. For more about the Lightning Network, read this article.

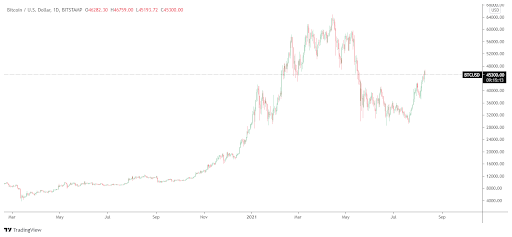

3. Bitcoin back above $45k

For the past few months, Bitcoin has languished in the $30-35k range, boring many casual observers with a lack of action. However, many hodlers have seen this period as a phenomenal opportunity to stack as many Sats as possible. Bitcoin has been in a bull market since mid 2020 and any consolidation period should be taken advantage of to the best of your means and ability. The recent spike in price, from around $30k to $45k indicates just how rapidly price action can gain momentum. Sitting on your hands waiting for a specific price as an entry point may be a losing strategy, as price may never again reach the level that you are waiting for. This is why we advocate for stacking Sats, the process of accumulating Bitcoin on a regular basis, without worrying about timing the market.

Are we going to see price action test $60k again soon? Who knows, but what we can tell you for sure is that over the long term price is either going to zero or going far higher than $60k.You decide which is more likely.

Currency debasement

In this weekly round-up, we harp on about a number of repeating topics: Inflation, private key ownership and Bitcoin maximalism to name a few. This week is no different, as we are going to draw some parallels between the inflationary policies employed by governments in history and how they caused currency collapses, and what we are seeing play out in central banks the world over today.

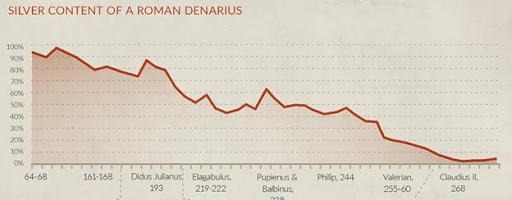

In the third century A.D. the Roman empire was in decline, plagued by slow growth, corruption, wars and financial crisis. The financial crisis component was created by over-taxation coupled with rampant inflation. Inflation is measured in many ways today, creating confusion as to what the term actually means. I find the most accurate way to describe inflation is the reduction in purchasing power of the unit of account. In this example, the Roman Denarius. During the first two centuries of the Roman Empire, the Denarius was 95% silver, with a weight of 4 grams. Fifty years later, the coin weighed 40 grams and was only 85% silver. Over the course of 100 years, the silver content of the coin declined to 60% and over the following 60 years it declined rapidly to a meager 5% silver content. Thus over the course of 200 years, the silver content of roman coinage declined 90%, until it was ultimately abandoned due to lack of faith in its value.

Following the collapse of the Denarius, new currencies were introduced, following a similar trajectory, albeit over a shorter period of time. This was coupled with price controls and other government edicts seeking to control the crisis. This was to no avail however and by the late 270’s prices had increased over 70-fold from where they were two centuries previously, with the bulk of the price inflation taking place in the last decade. The rest is history.

The Roman currency debasement serves as a great example of what we have seen in more recent times, such as the hyperinflationary events of Weimar Germany (1920’s) and Zimbabwe (2000’s). Both started out slowly, with central banks increasing the money supply by running the printers, without causing much negative impact, much like removing 5% of silver from a coin which is 95% silver, who is going to notice, right? Inflation starts slow, but picks up speed as the real value of the money is diluted. In Roman times this was achieved by diluting coinage with other base metals, less expensive to produce, such as tin or lead, in the modern era it is achieved by printing more notes or increasing the supply digitally. The end result is the same: decreasing the utility of money to serve as a measure of value until it is abandoned by the masses. This sounds rather academic, but what is actually taking place is that the elites who control the money printer are using it to steal from everybody else. Inflation is not a victimless crime, it is theft at the grandest scale possible!

Imagine this scenario: Central bankers print up a slew of fresh money, but need to inject it into the economy somehow in order to achieve their goals of “stabilizing the stock market”. So they start buying up equities with the freshly printed money. All things being equal, there is no new supply of equities and more money sloshing around, hence this bids the price of the equities up. Who does this benefit? Those who hold equities. This is what is called the Cantillon Effect, it benefits those who are closest to the money spigot, to the detriment of those furthest away from it. In this scenario, the poor, who do not hold any equity portfolios do not benefit at all from a rise in asset prices, but feel the decrease in their purchasing power as the freshly printed money works its way through the economy.

The Cantillon effect does not just operate in stock markets. Any government contract or tender which is performed by the private sector is paid for either by taxes raised by the government or money fresh off the printer. Those crony capitalists who position themselves closest to government and these contracts are the Cantillon class who benefit, while everyone else gets screwed.

Is it possible for government to self-correct? Let’s use South Africa as an example. In our country, the ANC maintains power through a patronage network of Cantillonaires. Each of these cronies get government tenders through political and family affiliations, receiving freshly printed cash to perform “services” for the government. Ignore for a second the dubious quality of these services and focus on the political ramifications of what would happen to the political stability of the ANC should it decide to become fiscally conservative overnight. If the ANC wishes to maintain political control, it must keep feeding the Cantillonaires. Thus it must keep printing money.

South Africa is not an isolated example of corruption driving government spending. Every country is the same. Politics is the game of positioning yourself as closely to the lawmaker as possible so as to gain an advantage. Ayn Rand captured this phenomena well in her book, Atlas Shrugged, where Dagny Taggart was the hard working industrialist who chose to make her way through skill and hard work, while her brother chose to build political influence and achieve success through corruption and graft. This metaphor holds true in every country on earth.

What choices do we have? We live in a soft money society, overrun with mediocrity and grift where those who choose to be Dagy Taggart, work as hard as possible and provide real value to society, run the risk of losing to a tenderpreneur like her brother?

Bitcoin fixes this.

Bitcoin is the hardest money known to man. No politician can change its monetary policy and those who hand out Bitcoin to their political lacky’s cannot print any more to keep the gravy train rolling. It kills corruption at its core: the money printer.

Rome, Germany, Zimbabwe, Venezuela etc were great societies built upon centuries of hard work, diligence and grit, all undone by greedy politicians who sought short term satisfaction at the expense of the many. The only reason why this was possible was because there was no separation of money and the state. Few men can be trusted with power, even fewer can be trusted with the money of a nation. This is why Satoshi created Bitcoin, so that we can be set free from the corrupt impulses of those who control the money printer.

If you think that politicians will give up this immense power without a fight, you are in for a nasty surprise. We have this one shot at giving humanity a tool that can be used to unleash our immense power for creation rather than destruction. It’s worth fighting for. Or we end up like Rome.

Read more about monetary debasement here.

Bitvice Podcasts and Media

This week we are excited to be interviewing Carel van Zyl, an OG Bitcoiner who has been involved in multiple startups, including Luno in the early days. We will be chatting to Carel about his opinions on Bitcoin, South Africa and the altcoins.

Another great podcast to listen to, which I think may be one of the best pods that I’ve listened to in the past year, is this interview between Marty Bent and Laser Hodl. Laser Hodl shares his views on what he thinks is going on in the madness that is 2020/2021, from the lens of the Great Reset.

You can follow our discussions on YouTube or via our podcast on Spotify, Google Podcasts or Apple Podcasts. If you are listening on a different podcast app, here is our RSS feed.

Since Bitcoin price is starting to move to the upside again, why not take the opportunity to secure your stack with a hardware wallet? The good folks over at Crypto Vault managed to survive the Durban riots last month with their business intact. Grab a Ledger or two from them.