Bitcoin faces challenges as governments and traditional banks have turned aggressive towards the network, other Crypto and more so – its providers.

The government’s “Choke Point 2.0” strategy is one of the latest tactics to curb the use of Bitcoin and other cryptocurrencies. They state it is for the reduction in ‘illicit activities’ but any person with a reasonable IQ can see otherwise. This move includes cutting off access to payment processors and banks that provide services to Bitcoin exchanges and other cryptocurrency-related businesses.

For instance, Kraken, a prominent cryptocurrency exchange, has had issues with its ACH onramp, which allows users to buy Bitcoin with US dollars. The onramp was suspended due to regulatory concerns, leading to delays and frustration for Kraken’s customers.

Hindenburg Research has just attacked Jack Dorsey and his company, Block which has a number of Bitcoin products in the US (Cash App etc.) with heinous accusations.

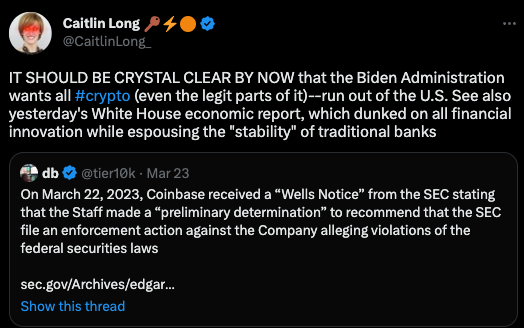

The SEC is going after Coinbase, the largest Crypto provider in the US with a Wells notice. However, this notice is aimed at ‘Staking’ and certain ‘asset listings’. In other words, not Bitcoin.

The SEC has also just laid formal charges against eight celebrities for ‘illegally touting’ certain Cryptos, without disclosing that they were paid to do so.

This is nothing new in the world of securities, which Sh#tcoins most certainly are.

Additionally, traditional banks have been cracking down on the use of credit cards to purchase Bitcoin and other cryptocurrencies.

In 2018, JPMorgan Chase, Bank of America, and Citigroup all banned their customers from using their credit cards to buy cryptocurrencies due to the risks involved with volatile prices and potential for fraud.

Furthermore, some countries like China have banned cryptocurrency mining and trading, This move came after China’s central bank announced that all cryptocurrency-related activities were illegal and issued a notice to financial institutions to stop facilitating transactions involving cryptocurrencies. This had a massive impact on Bitcoin in 2021 but its effects on Bitcoin’s hash rate have since been erased.

But the cherry on top of all of this, was the Whitehouse report on Crypto that came out this week.

In the ‘Digital Assets: Relearning Economic Principles’ section, they summarises a few strengths of Bitcoin, yet they go all out on the dangers of this asset class.

They state that the US Dollar and the world’s inherent trust in it, trumps Bitcoin. They throw positivity at Ethereum’s move to Proof of Stake, and wonder why Bitcoin has not done the same. And of course, they elude to the inevitable US CBDC, which will offer ‘significant benefits’ to the nation.

TLDR: The Whitehouse says most crypto assets have ‘no fundamental value.’

The Whitehouse dedicated 30 pages of this report to point to the fact above. That Bitcoin is worth nothing and is not deemed an alternative to the might of the US Dollar.

So, why write 30 pages on something that does not matter?

Oh the irony.

Despite these challenges, many proponents of Bitcoin argue that it offers an alternative to the traditional banking system and can provide financial services to those who are unbanked or underbanked. They believe that Bitcoin’s decentralization and security features make it a valuable asset for the future of finance.

Looking back at the original Operation Choke Point 1.0 a decade ago:

‘”…the true goal of Operation Choke Point is not to cut off actual fraudsters’ access to the financial system, but rather to eliminate legal financial services to which the Department objects.” – Darrel Issa

In conclusion, one needs to look at the value of assets in the past – when governments banned them. Secondly, it is vital that everyone needs to understand why Bitcoin is separate from the rest of Crypto. Yes, it has a POW network blah blah blah.

But the true separation lies in its anti-fragility. Bitcoiners have warned people for years that Central Powers will come after crypto. This is happening right now.

Bitcoin is the only one who stands a chance against them.

People who hold their own Bitcoin stand a chance against them.

All other cryptos (securities) have endless points of weakness. People who hold their Bitcoin with custodians have endless points of risk.

Yes, governments and banks can cut on and off-ramps. But who can stop a network with hundreds of thousands of nodes, millions of participants who can simply trade peer-to-peer and who can just move their funds to friendly jurisdictions with 12 words in their heads?

Something to think about.

Best Podcast of the Week

This week, we suggest taking a look at the ever-fantastic articles from Lyn Alden – in audio format.

You can catch the audio version of Lyn Alden’s latest article on ‘How the Fed Went Broke’.

Lyn explains how the Fed has raised its own liabilities by raising rates at the quickest rate we’ve ever seen – effectively making them operate at a loss for the last 6 months.