The bear market. Here we are again. Or, to some, welcome for the first time.

It’s that time of the cycle, where conviction is being tested and a reality check is needed for most.

To many readers, you are here because no matter what price you bought at, whichever friend you listened to or whatever reason you think you may have bought Bitcoin; you actually bought Bitcoin for one reason. You may or may not realise it yet, but you made a bet against the current system. You hedged against manipulation. Bear markets make investors realise this. And unfortunately, this bet you made is the furthest thing from being easy.

Many people, in all markets, are reeling from the chaos caused by a few things.

Before we talk about Bitcoin, we need to think of those in equities and of the less fortunate; those in Altcoins.

The Nasdaq recently dropped by 13% in a single day. The largest dive since the 2008 financial crisis.

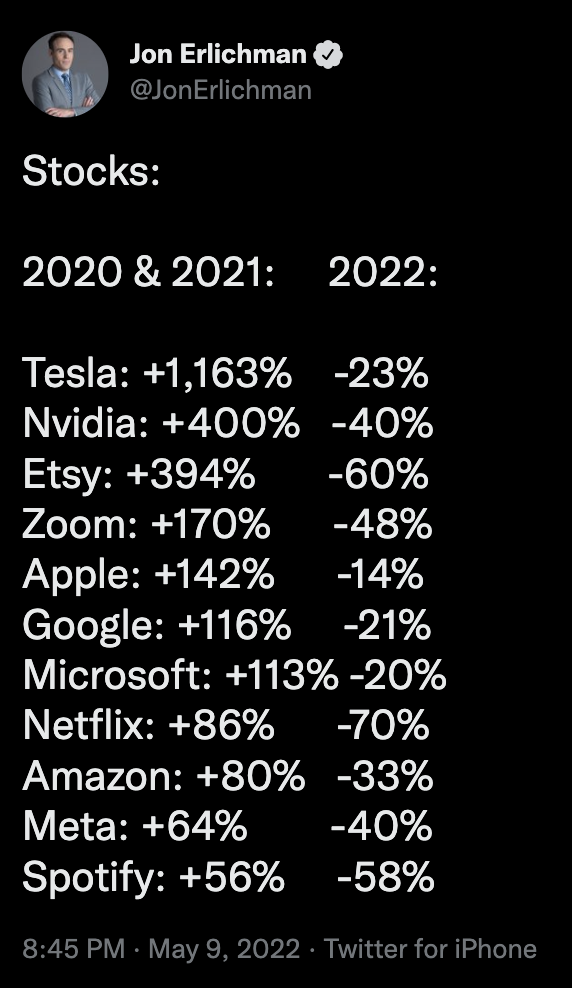

And when looking at the darlings of the American market, it’s not a pretty sight:

Essentially, $20 Trillion in household net worth has been wiped out in 2022 alone.

Basically, everything but the Dollar is hurting. Over the past few years, those who have held the Dollar have been in a world of pain, and now the tables have turned.

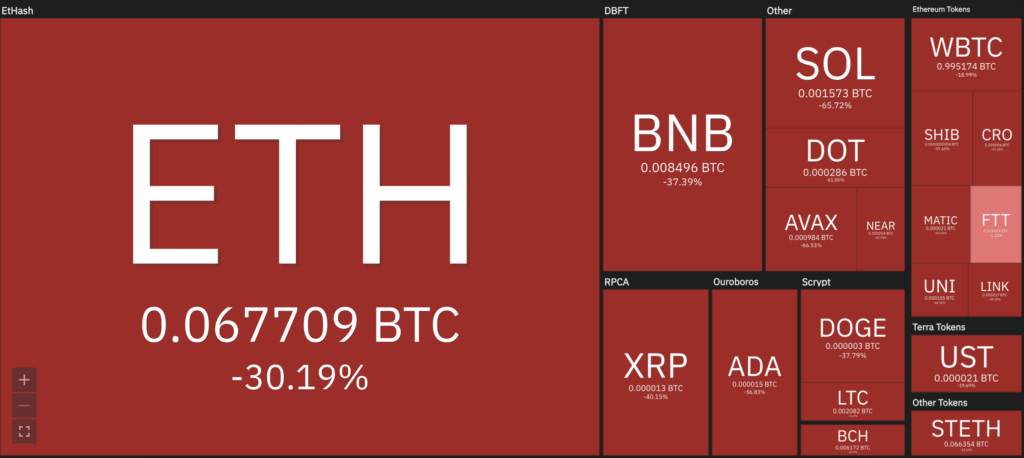

And finally, those who have held the riskiest assets of all, are hurting the most.

Here’s the Altcoin market’s performance against Bitcoin (not the US Dollar) for the period, 1 January 2022 to now:

That’s enough negativity for now. Let’s not pander on the current state of things.

Let’s look at what the likeliest causes of the aforementioned state are and what the paths forward could possibly be.

In the past few days, the recent price decline in crypto can be closely tied to the Luna/TerraUSD debacle.

The 2-year old, Billion-Dollar, Algorithmic, Shitcoin ponzi chose to deploy capital into Bitcoin, around 2 months ago. This ‘algo’ stablecoin project utilises a complex mix of underlying assets and code to ‘automatically’ maintain a peg to the US Dollar.

One asset in this basket is Bitcoin, and there was (and still is) a lot of Bitcoin under the control of Luna Foundation Guard, a shitcoin council who are essentially a group of neotype central bankers; deeming themselves of use when in fact, they are the furthest thing from it.

Due to overcomplexity and therefore, risk; things quickly went wrong.

The Luna council has recently confirmed that they would need to support their UST dollar peg, by selling around $3 Billion of its Bitcoin reserves.

However, this didn’t help their ponzi at all.

So, in summary, there has been quite a lot of selling pressure on the markets. And quite frankly, as most of the market considers Bitcoin within the same vertical as Crypto (which is the furthest thing from the truth), I am quite surprised that Bitcoin is holding close to $30,000.

Now that we’ve talked about the short-term shenanigans, let’s look at the stuff that really matters.

As stated many times before in my previous newsletters, Quantitative Tightening was always knocking on our door. And unfortunately (or fortunately depending on how you’re looking at it) QT is here.

The US Fed, which is in the tightest of corners one can ever imagine, recently decided that inflation was a bigger concern than Wallstreet’s greed. They raised the benchmark interest rate by 0.5 percentage points which is the largest hike since 2000. This is already after a recent 0.25 percentage point raise in March.

This has caused widespread panic throughout all markets.

Even the most Bullish investors on this planet, like Cathy Woods of ARK have capitulated on their positivity and have blamed the market selloff on the Fed.

Unfortunately, inflation finally caught up with the bankers who were extremely blasé about printing so much money, humanity didn’t quite know what to do with themselves.

Not even a year ago, Powell, Yellen and their crew were totally unconcerned with what their actions would cause:

Compare this to the latest US inflation figures that came out yesterday:

Right now, the Fed plans to hike rates again in June and July. The market is pricing in 25bps in each hike.

Overall Y-on-Y CPI in the US came down from 8.5% to 8.3% this month and it’s now a question as to whether the Fed will raise rates only enough to continue deflating the market so as to stave off inflation.

Or, at what point will the bankers capitulate to the politicians with mid-terms just around the corner. Or even to Wallstreet, as lobbyists pound on their doors.

Once again, these are short-term potentialities. There are bigger factors at play.

We need to look at the fiat system and the credit markets. I want to summarise a fantastic thread by Allen Farrington, whose nuance is able to cover this complex order of things:

- When the monetary system is structured as debt, unbacked credit expansion is almost always the chosen form of finance.

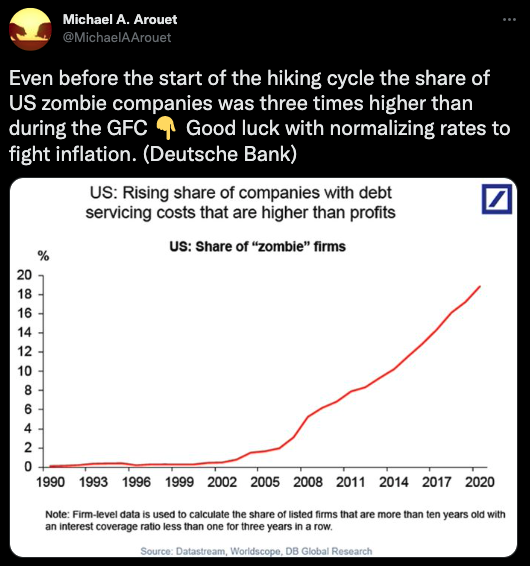

- Unbacked credit is inherently and artificially cheap. This leads to misallocation of capital which pushes its elasticity towards extremely unsustainable leverage.

- All players in this system won’t be able to deleverage themselves, because this leads to a disadvantage and so old leverage becomes more leverage. This is how we have come to see equities with P/E ratios far beyond normality and sustainability.

4. When the Fed or other central banks raise rates, this leverage becomes unaffordable to many. Suddenly, the expansion in leverage contracts and so inflation comes down and we see unemployment rise due to the original misallocated capital.

5. Now, if rates never rose – this expansion, misallocation, employment and inflation continues.

This is all fairly reasonable at this point. And many overpaid fiat economists would agree.

However, in this environment (which we are in now) due to existing misallocated capital, refinancing of debt becomes close to impossible, this drives the downward spiral of markets, specifically equities.

The Fed could then step in and begin QE measures and lower interest rates. However, the elasticity in misallocated capital is still stretched and no further amount of credit expansion can hold everything up.

This is what Greg Foss refers to as ‘credit contagion’.

Just like degenerate crypto traders, the big boys get liquidated as well.

Unemployment continues and so does inflation unfortunately. As misallocated capital gets washed out, the supply of goods and services does as well. This drives up prices in most things of course.

Liquidations and unemployment is further forestalled by continuing to monetize the debt (print more money). This continues to drive inflation up.

This is called Stagflation and then Hyperinflation.

The current order of things tries to maintain its order, yet it actually begins to eat itself.

With fiat money structured as it is, misallocation will continue to a point of critical mass. New solutions, based on archaic theories and politics will only prolong its decimation.

And unfortunately, all along, Cantillionaires will continue to eat up the cheapest debt, at the top of the pile and end up richer than us, in a fiat world where no one is actually getting wealthier.

Joe Nocera states: ‘debt creates inflation and inflation creates the need for more debt.’

Ok, so that was probably dreadful to read. What the hell do we do now?

We need to accept the world we are in, is nothing more than an addict on the drip of perpetual debt that simply cannot be paid back.

The first thing that any addict admits in their steps towards recovery is acceptance. We need to accept that this current system will only worsen, no matter what path it takes except a total reset. And no, I’m not referring to our friend Klaus Schwab’s vision – but one where the most fundamental tool for a functional society, money, cannot be controlled and corrupted by the few.

The Cantillionaires will implement short-term remedies, like Bretton Woods III which I explained in my previous blog. However, these changes are around protecting reserves against custodians. These do not fix the underlying issue; debt as the format of money and its misallocation thereof.

We need to also accept that things will be tough in the years ahead, as the world comes to realise the doom-loop that they are in.

We need to accept that Bitcoin will be attacked from every side. Every banker and altcoiner will continue to try and destroy Bitcoin, as they are now with the ‘Bitcoin uses too much energy’ narrative. The FUD will continue to evolve until it cannot anymore. It simply has everyone against it, which in the end only makes it stronger. People will come to realise in tough times, that fundamentals matter – and that energy and Proof of Work is actually imperative for a secure, incorruptible format of money.

In these difficult times, remember that Bitcoiners around you, eventually stop talking about the price and the ‘moon’. They realise that things will be tough. That is why the term ‘Hold on for Dear Life (HODL)’ is said over and over, even in the most insane bull markets. We know that there are always good times and always bad times.

Accept that volatility is good. Because you’ve learned something that most haven’t.

Accept that you made a tough decision. That you made a hedge against the current order. That it is impossible for the central banks to keep the tap turned off. That their own tools are their biggest enemy. That you made a bet that human ingenuity will find a way to remove these rulers that have caused so many socio economic ills.

Accept that this is a long-term bet and the price of Bitcoin will make you both happy and sad. Eventually, like many others, you will become numb to it all as you continue to understand the true nature and power of the most important invention that mankind has seen in decades. Many crypto providers and exchanges will die along the way, taking investors’ money with them. This is the time to self-custody for the long-term and trust you, and you alone, with your Bitcoin.

Accept that we are all on an S-Curve of adoption and over the long-term, a simple pattern plays out:

And lastly, in the words of Michael Saylor, ‘The Bitcoin price is set by those with more money and less knowledge than you. In time, they will get the knowledge and you will get the money.’

HODL.