As a war rages on this week, Gold bugs have had a pretty good time with its recent swing to the upside.

Russia has had a pretty terrible time with its gold reserves. US Senators have just introduced a bill to seize Russia’s gold reserves and as I stated last week – a critical moment in history was made, when Russia’s foreign reserves were locked through sanctions.

The long term repercussions of this, are going to be frightening to many who like things to remain the same. Because this was the point of critical mass for the US Dollar and America’s hold on nations through their reserve currency.

Credit Suisse released a report this week and stated, ‘After this war, money will never be the same.’

I want to go through exactly what this means, but let’s see what else happened this week:

Apple co-founder says Bitcoin is the only crypto with ‘pure-gold mathematics’

Steve Wozniak of Apple fame, has been a big proponent of crypto for a few years. In a recent interview with Business Insider he discussed the current crypto ecosystem and he raised some concerns.

‘There’s so many cryptocurrencies that come out now… everybody has a way to create a new one and you have a celebrity star with it…’

Wozniak concluded his interview by talking about Bitcoin and the need to completely separate it from everything else, especially other cryptos.

‘Bitcoin is mathematics, mathematical purity… There can never be another Bitcoin created… Bitcoin isn’t run by some company. It’s just mathematically pure. And I believe nature over humans, always.’

Meanwhile, Bill Gates of Zune, terrible software, the WEF and ‘the dire need for depopulation’ fame, confirmed he is ‘not bullish on Bitcoin.’

Take that as you will.

Macro watch

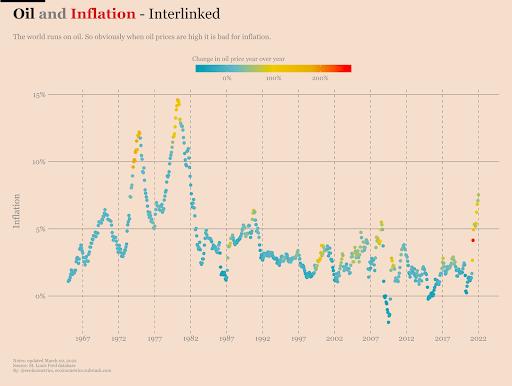

To summarise my personal view on the current situation with commodity prices, I do not envy the Fed, the ECB or most central bankers facing the dire need to raise rates.

All of them, especially the Fed, are under enormous pressure to raise rates to fight off inflationary pressures.

But, Biden has just confirmed the US will ban the import of Russian oil:

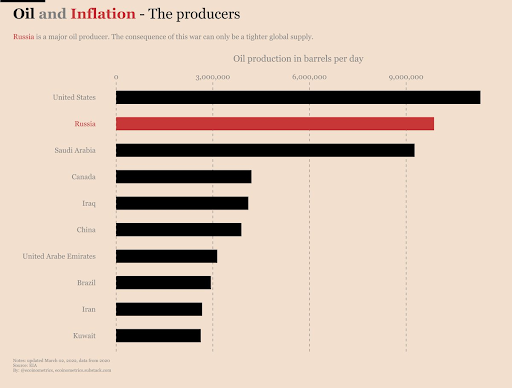

Russia’s production, on par with the Saudis, feeds a lot of the world’s demand. And when the production of 9 million barrels are affected (not all, since there’s still quite a few countries which have not banned it), one can only expect elevated oil prices from here.

Higher oil prices affect hundreds of thousands of consumer products on the shelf and of course, the underlying costs to transport products.

The Fed and other Central Banks are in a pickle at this point.

Since, oil prices have and will undoubtedly cause further inflation, above the enormous pressures caused by their love for printing money – raising rates becomes a knife in a gun fight.

Even though the Fed has stated they intend to begin raising rates in March (we’re still waiting), there is a big chance this will have no impact on fighting inflation. This would probably cause risk-on assets (the stock market etc.) to continue downwards and the Fed would be blamed for this.

If they don’t raise rates, inflation is going to continue anyway, and they’ll be blamed for doing nothing.

Commodities and scarce assets will be a safe haven and if Bitcoin maintains its narrative of digital gold and a hedge against inflation – expect more newcomers.

Join us on Twitter on Monday to talk about Bitcoin, self-custody and security

In a world where governments and regulators are seizing/blocking assets left, right and center – we are holding Twitter a Space to answer any questions people have about how to hold Bitcoin themselves.

We will discuss the merits (and risks) of mobile, hardware and multisig setups. We will also discuss where some people have gone wrong and also, what people have done right.

Join us on Monday, 14 March, at 7pm. You can set a reminder and listen to the space here – on your mobile or desktop.

Hope to see you there!

Nation states are awakening to the new world order (and a new world money)

To kick this off, I would suggest reading Ray Daylio’s book, Principles for Dealing with the Changing World Order.

You can also watch an awesome video of his thesis, here. And can read a recent article of his, around the recent conflict in Ukraine here.

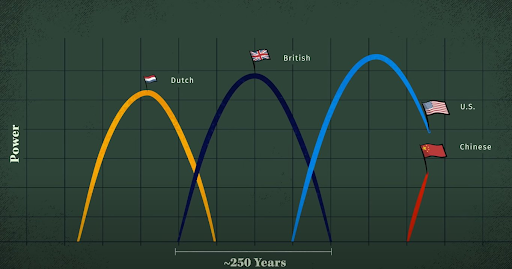

The graphic below, is the overarching theme of the book and video. And based on a few long-term cycles, we are in the midst of a massive shakeup that happens every 250 years.

His thesis is that the largest economies become so through hard work, education, military might, a robust financial system and via their currency becoming the reserve unit for the entire world.

This all takes time, as it did for the Dutch, the British and the Americans.

However, this eventually leads to inefficiencies in their domestic markets, higher labor costs and over-indebtedness brought on through exporting their currency worldwide.

Look, there’s obviously more nuance to this, so I would suggest reading or watching his material to understand this more.

The thing I want to focus on is the changing of the monetary order and the reserve currency. Once again, as a result of the US blocking Russian reserves and also introducing legislation to block their gold, there will be cataclysmic events to how money works in the world.

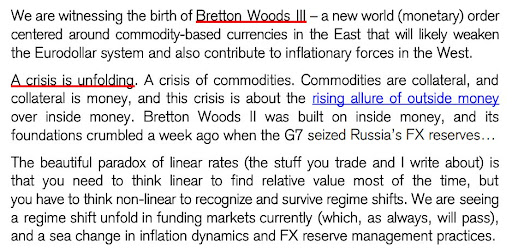

Credit Suisse, one of the largest financial institutions in the world, just released an article.

Below are some excerpts:

Ok, so what does this all actually mean?

Firstly, one of their conclusions is that the recent conflict and the ensuing fiscal/economic/political events will be a massive variable in the shift to a new, global financial order in which Bitcoin is set to benefit.

In other words, these recent sanctions will cause a shift in sovereign-nation-thinking and a ‘Bretton Woods III’.

“From the Bretton Woods era backed by gold bullion, to Bretton Woods II backed by inside money, to Bretton Woods III backed by outside money,”

So, this essentially means nation states would move from the current system, where reserves are kept as liabilities, to a system where reserves are kept as commodities. Why would any nation state choose another to custody their reserves, after what happened to Russia?

The author of the report also said, “If you believe that the West can craft sanctions that maximize pain for Russia while minimizing financial stability risks and price stability risks in the West, you could also believe in unicorns…”

So, taking Ray Dalio’s and Credit Suisse’s views into consideration, it is quite clear that China is moving towards shaking the world order. The US is a catalyst towards this right now, as their financial weapons will in fact go against them.

As the world moves towards a system of ‘outside money’ (reserves kept as commodities), the Eurodollar system will find itself in deep trouble. This, together with central banks having no tool to dig themselves out of debt other than more money printing, is going to lead to further inflationary forces in the West.

“When this crisis (and war) is over, the U.S. dollar should be much weaker and, on the flipside, the renminbi much stronger, backed by a basket of commodities…”

And the kicker out of this all?

“After this war is over, ‘money’ will never be the same again… and Bitcoin (if it still exists then) will probably benefit from all this.”

But why would it? Well, gold and other commodities will certainly be big winners in all of this chaos.

But remember, Gold reserves are extremely hard to validate or authenticate. Only paper gold is really reported, but no one outside of government really knows how much gold is held by each country.

If nation states choose to go the route of outside money, there will undoubtedly be massive issues and confrontations around trade etc. – as a result of the absolute certainty that some players will manipulate the situation. This is due to the inherent non-transparency of gold and other physical assets held in reserves.

Bitcoin is completely transparent. Anyone can prove how much Bitcoin they have in their public address, through their private keys. If people continue to understand the nature of this thing and it maintains its ‘digital gold’ narrative – I don’t think many people can comprehend the future forecasted value of this asset and network.

Bitvice Podcasts and Media

On our latest pod Ricki chats to Brian Harrington a Bitcoin pleb who has been tinkering with home Bitcoin mining over the past few years. He started slow, just running a single s9 off regular power from his utility provider, but has since moved toward integrating his miners with his home solar power system. Brian details how you too can do the same in your home.

Check out the full episode here and subscribe to our channels to get notified as soon as a new pod is released!

By The Horns is a Bitcoin podcast from a South African perspective. You can watch our discussions on YouTube and Rumble or listen to the audio version on Breez, Spotify, Google Podcasts, Apple Podcasts or via our RSS feed.

As always, keep holding, keep stacking, keep learning and make sure you self-custody your Bitcoin.