You may have heard about the website wtfhappenedin1971.com and if you haven’t – man oh man, I would suggest you go down the rabbit hole.

To put it simply, it was the moment Richard Nixon moved off the gold standard and the fiat system was born.

I firmly believe that the next generation/s will look back and deem this as a dark, dark moment in mankind’s history and yet, most people don’t even know what it is.

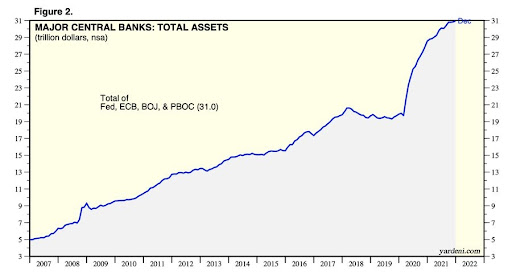

Below, we can look at what has transpired over just 15 years. The main Central Banks (only 4 of them) have printed more than $25 Trillion in such a small amount of time. Remember in 2008 when there was an absolute uproar when the banks were seeking around $800 Billion for bailouts. This was around the time the first iphone was released. Now, 12 iphones later – $800 Billion is a completely insignificant amount of money in the grand scheme of things.

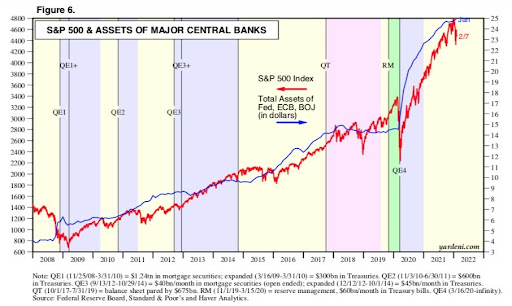

Now, take a look at the S&P 500 against the central banks’ printing over the past 15 years. The correlation between central bank liquidity and equity market returns – is quite blatant.

It could be said that we are close to the Weimar Moment on a global scale. The moment when everyone thinks they’re getting rich, when in fact – nobody is. We are at a crossroads where massive institutions (Cantillionaires) are the ones closest to the printing trough. They are the first recipients of central bank liquidity at the cheapest rates. The fiat system allows these institutions to increase in scale whilst small businesses continue in a completely manipulated and unfair market.

These massive institutions are so large – they are incapable of producing high-net, organic growth and returns on an annual basis. Only the small innovators, with high-risk profiles can attain such growth through some kind of incredible product. Thus, the real return on the S&P 500 against the Fed’s relentless money printing is laughable. The US Dollar M2 supply increased by 35.7% from Dec 2019 to Aug 2021. Anyone would be losing money if they got a 15% annual return on some kind of balanced fund.

If one simply lifts the veil and looks at the utter absurdity of the credit and equity landscape – the reality of it all would scare anyone.

This is all happening now, but let’s also look at what has happened to the world since 1971. I’ll talk through a couple of the website’s graphs.

What the f#ck happened in 1971?

In August 1971, President Nixon ‘severed the direct convertibility of U.S dollars into gold.’ This moment is referred to as the ‘Nixon shock’ and is one of the most important events in mankind’s recent history.

It set the foundation for the fiat system and for the first time in history, the creation of money essentially cost nothing and was backed by nothing other than military might.

The ramifications of this led to enormous short-term inflation in the US in the 1970s, the near collapse of the financial system in 2008 and to the speculative mania and complete idiocracy we find ourselves in today.

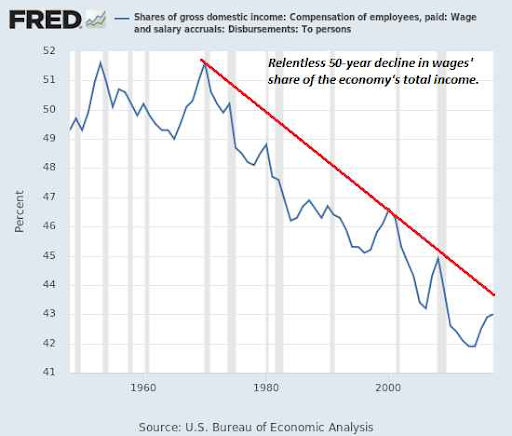

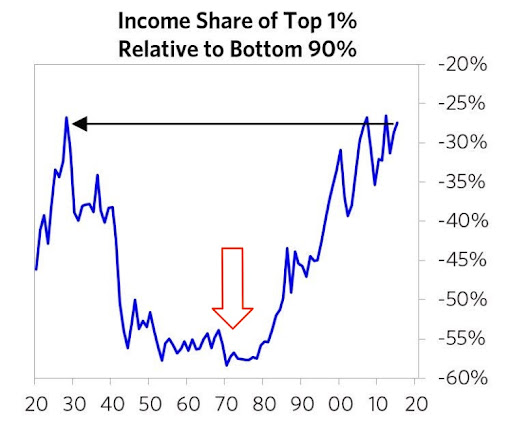

Because fiat led to a world of inflation and a Cantillionare’s paradise, we have seen:

1. A steady decline in wages

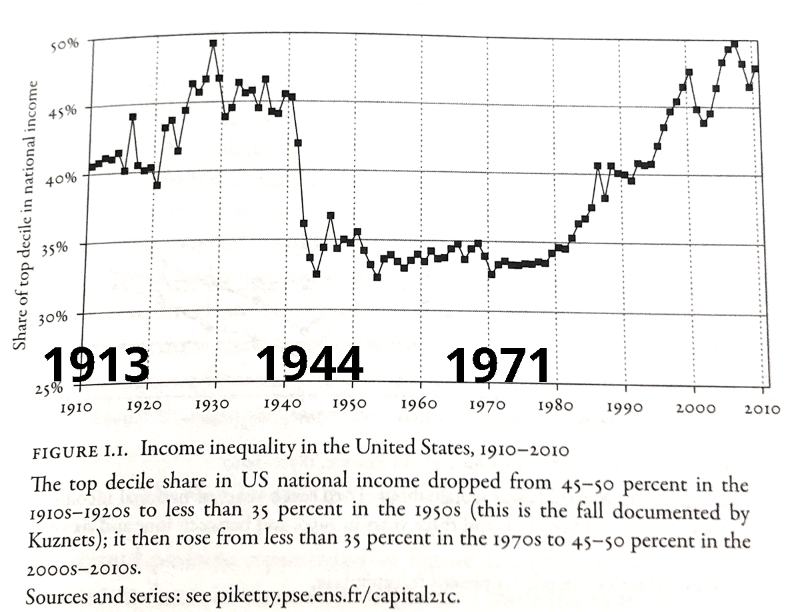

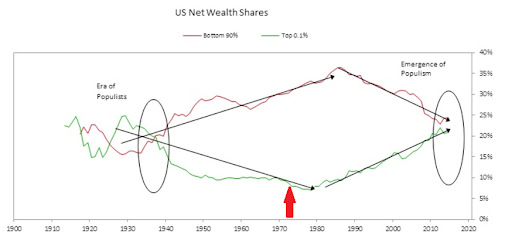

2. A dangerous and uncontrollable gap in inequality:

The increase in inequality and the ever-expanding pockets of the 1%, has led us towards a new cycle of populism and the emergence of socialist orders. This is simply a repeat of history and if you were to read The Fourth Turning, the patterns of men on a macro level are cyclical in nature.

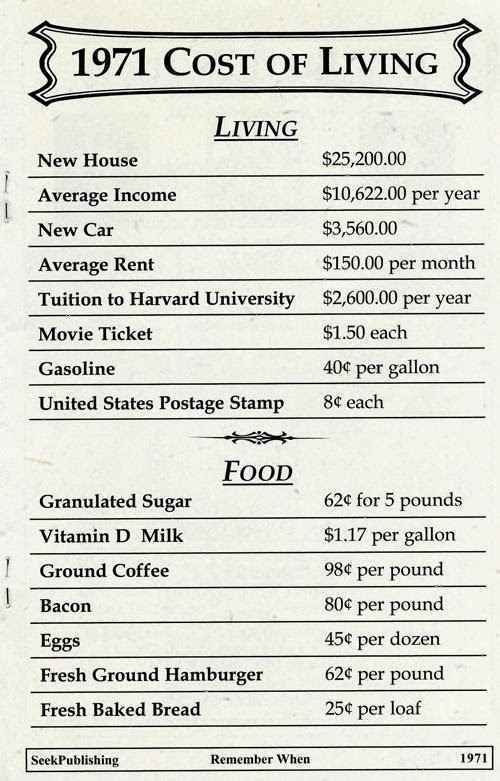

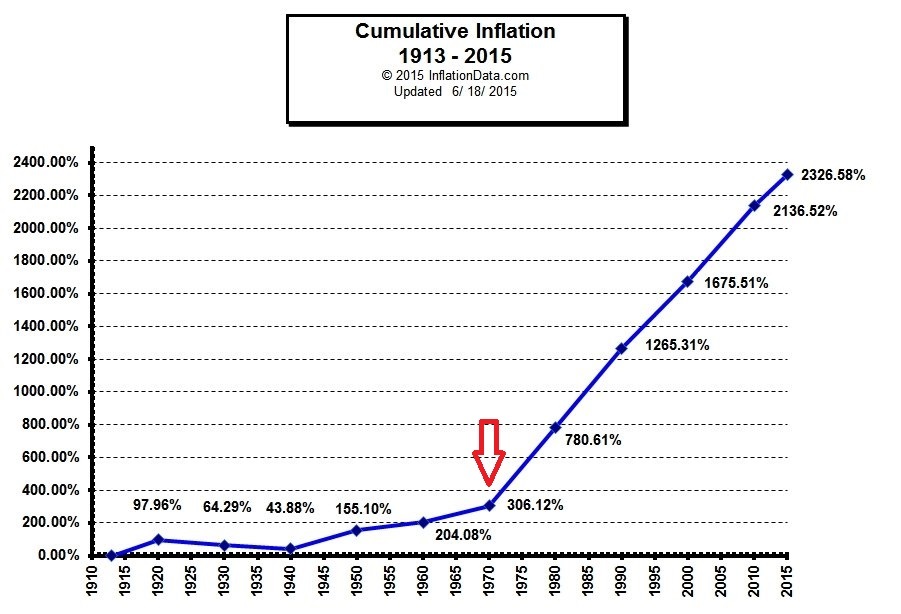

Inflation, of course, has been a key characteristic of the world order since 1971:

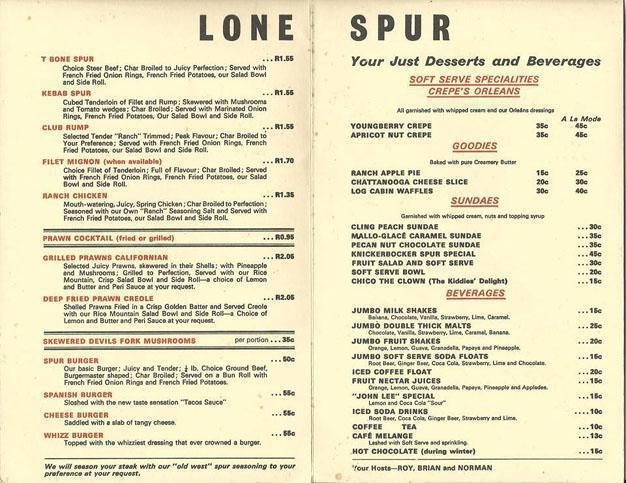

Here is a Spur menu from 1973:

And take a look at what the CPI looked like in the US before and after 1971:

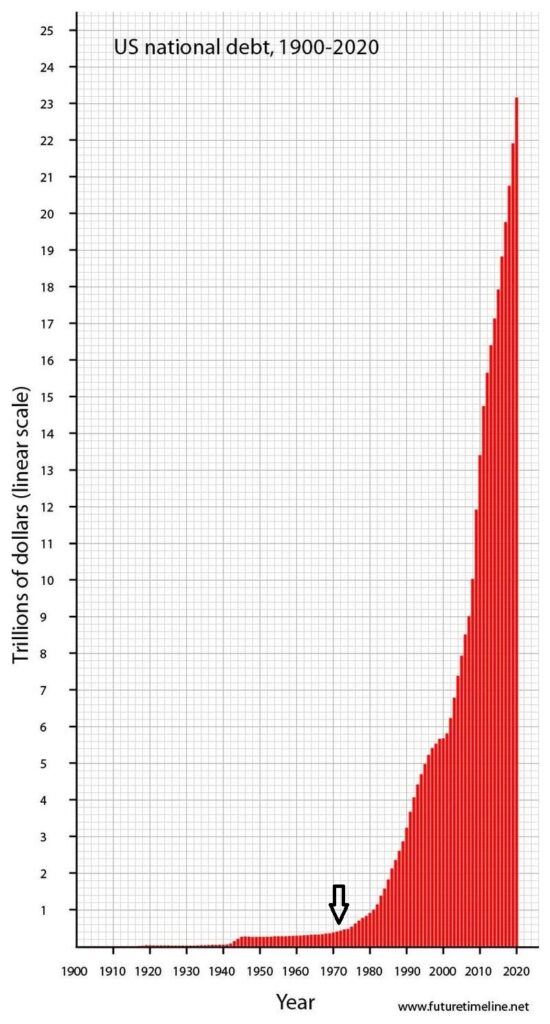

Fiat money became so easy to create and because of this, governments were able to take on more and more debt to finance wars and inefficient civil services. The world has become centrally controlled by the few only because the money allowed them to become so big in the first place:

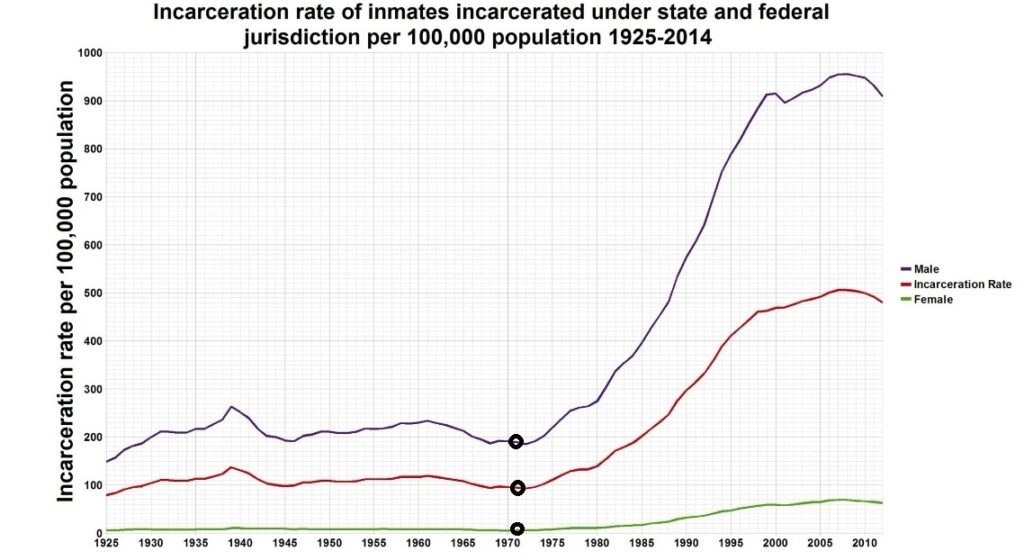

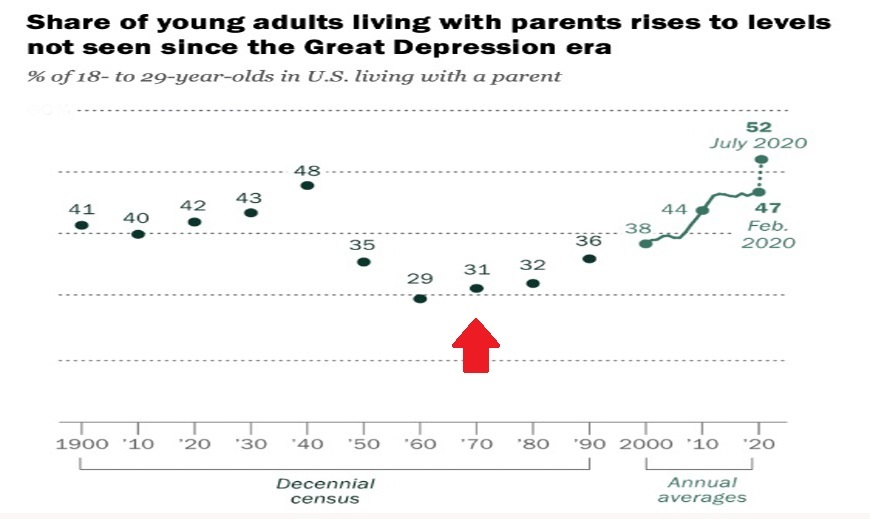

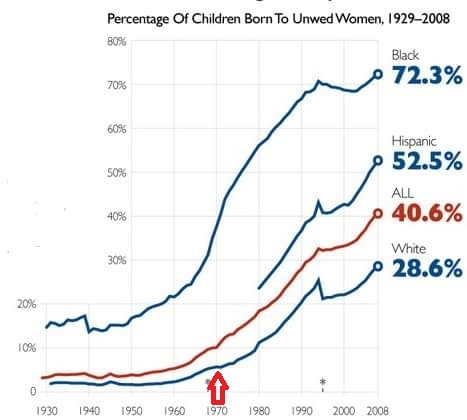

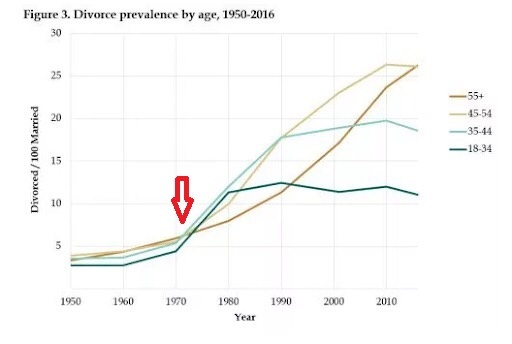

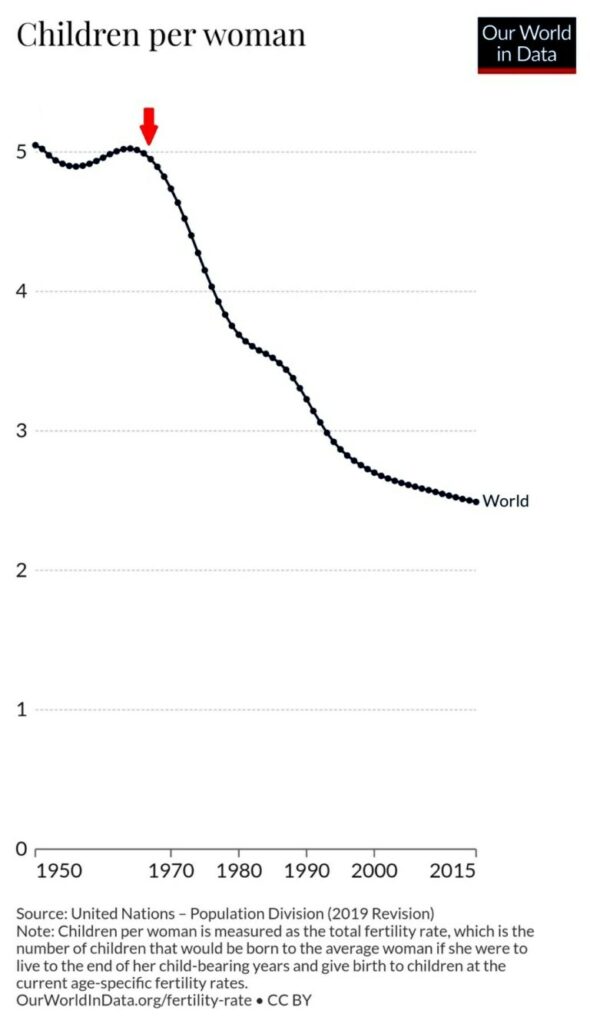

And all of this, once again, has led to a world with bigger governments, monopolistic companies, propagandic media and an uncontrollable gap in equality. The sociopolitical effects can be seen far and wide:

That’s enough graphs for now and I really suggest going through the website in full, when you have the time.

The figures outline the underlying problems and most Bitcoiners believe that most of the world’s problems begin with the structure and source of money.

All fiat money is debt. Every one Dollar, Rand, Euro etc. that is printed, equals one unit of debt. The inflationary pressures from this perpetual debt leads to the continuous devaluation of these currencies. This leads to a world of consumerism, short-sightedness and high time preference.

Bitcoin changes this mentality. This is a predetermined system where the supply is known, the cap is unchangeable and where inherent uncertainty is zero. Yes, there are many external risks and uncertainties to Bitcoin but internally, it is all incorruptible math.

With more adoption, it removes the ability for the central powers to fund their inadequate and inefficient measures. The open and free network brings about a new open and free economy – where free market principles are unrestricted.

The restricted supply, scarcity, certainty and Number Go Up technology of Bitcoin brings about a new paradigm to many. People choose to save, rather than consume. Debt is no longer the basis of money. And the world could move towards a state of low time preference. A state where over consumption and debt is not a plague on society. Where the unit of account in their hands doesn’t dissipate over time. This is a world where people can begin to think for the long term.

Where they can protect their wealth in a system that cannot be corrupted. Where they can have real hope to have a home, a family and a future.

I hope you enjoyed this one and I hope ‘1971’ has become a number that will stay in your mind for some time. Keep focusing on the truth. Keep the veil away.