As we mentioned in our last newsletter, on the 18th of October, The USA’s SEC formally unblocked Bitcoin ETF submissions, laying the foundation for a plethora of new ETFs that have entered and will enter the US market. After 7-8 years – it has finally become a reality.

It’s quite an interesting time we’re living in right now. On the one hand, China has banned Bitcoin completely (or so it seems, more below) and the US has accepted Bitcoin with open arms.

I don’t say this easily, but it seems like Bitcoin will not be banned by the US anytime soon. The mere fact that a considerable amount of ETFs are deploying into the market and the fact that the Fed Chair stated that they have ‘no intention to ban Bitcoin’ means a lot of institutional money is about to become wrapped-up in Bitcoin. This is good for you and me in the short term and maybe the long term, but nothing in the world comes without risk.

Many mainstream media platforms, crypto exchanges and others have screamed the ETF news to the world and have tried to capitalize on this to drive FOMO into Bitcoin and increase clicks or transactions. If you search for ETF articles on ‘normal’ channels, there’s nothing but vapid hyperbole that praises the launch of these institutional-accepted investment vehicles.

Well, we just like to tell the story like it is, based on our opinion. Yes, this will probably bring Billions if not Trillions of Dollars into Bitcoin and drive the price up, but there’s also the bad side of it.

We’ll do a deep dive.

But first, the news:

1. Mastercard brings Bitcoin to its network

Alongside Visa, Mastercard (worth +$300Bn) is now bringing Bitcoin to all of its merchants; starting with the USA of course.

Mastercard, in a partnership with Bakkt (a crypto wallet provider and reward aggregator) will offer Bitcoin custodial services to the millions of merchants on the Mastercard network, over time.

Merchants will not only be able to accept Bitcoin as payment, they will also be able to send and receive Bitcoin, provide Bitcoin reward/loyalty functionality (cashback) and will also provide the ability for users to exchange loyalty points, such as air miles, into Bitcoin.

Gradually, then suddenly. That is Bitcoin’s way.

2. China could be unbanning Bitcoin

And the funny news for the week is that China is once again not sure what its stance on Bitcoin is.

Normally, China would do its standard quarterly announcement to state it’s banning Bitcoin again.

However, as you may recall, China did officially ban Bitcoin in May this year – which was certainly a large factor in driving the price down to ~$30,000 a few months ago.

Now, it seems like China is trying to determine whether it should remove the blanket ban on the asset for retail and institutional investors.

We said this was going to be one of the biggest mistakes that China ever made and whether they change their mind or not, they have lost an incredible amount of hashpower to the US, Kazakhstan and other countries. More than 30% of China’s hashpower has been moved to the US, based on certain sources.

Nigeria tried to ‘ban’ Bitcoin last year and changed their minds after realising how ineffective it is to try and take Bitcoin down.

Hopefully, other nations are seeing a pattern here and learn from these precedents.

3. Billionaires are talking about hyperinflation

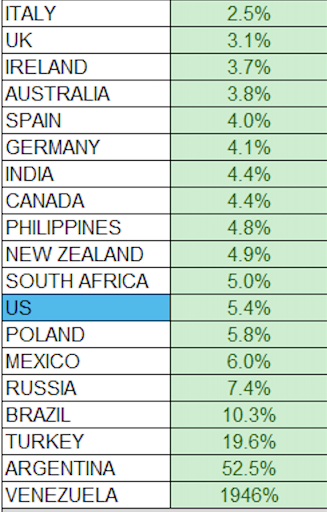

Inflation is starting to become the talk of the town and the reported annual CPI rates are currently standing at:

As you can see, the reported CPI in South Africa is currently standing at 5.0%, just below the US at 5.4%.

However, many have argued whether the CPI is an accurate measuring tool at all. Personally, I don’t believe it is. I think one needs to look at the raw material inflation rate, which then feeds into its byproducts.

Lyn Alden wrote about the impending oil and gas ‘bull market’ that is heading our way, back in June 2021. Well, quite frankly, these commodities are definitely seeing an increase in price. South Africa will soon see a R1 increase in the petrol price alone.

Lyn quotes Rick Rule in her article who said, “Bear markets are the authors of bull markets, and bull markets are the authors of bear markets.”

To summarise what this means:

When commodity prices are high, whether it’s gold or oil or copper or something else, it attracts a ton of producers to spend money on exploration, development, and extraction of those relevant commodities. This tendency, combined with cyclical demand, eventually results in a period of oversupply, which leads prices to crash.

“When commodity prices are low for a while, few entities want to invest capital into the space to find and produce more supply. Eventually, demand outpaces supply and causes an imbalance, rocketing up the prices. This starts the cycle anew.

Right now, many macro analysts, including Lyn Alden, are stating that the cycle we are in right now, is of higher demand, low & ineffective supply and so prices are starting to be affected to the upside.

Look at oil. We create tens of thousands of products from oil that fill our grocery stores and homes. Due to supply issues across the world, borne from COVID and low investment over the past 2 years, oil’s price is probably going nowhere but up in the next few months. There is massive misalignment in demand and supply globally.

Let’s also take a look at natural gas prices, especially the UK:

Expect this underlying inflation to continue feeding into our everyday items.

Bitcoiners have been talking about this since last year, when we could all see that the endless central bank liquidity and ineffective government measures were going to lead us to an inflationary world. But not a lot of people have taken notice until now.

Even prime time news stations in the US are starting to talk about this in the US. And, Billionaires are starting to talk about it too:

We are firmly with Michael Saylor on this one. We believe the best method of protecting one’s wealth is placing it in the scarcest and most secure asset on this planet.

What is the Bitcoin ETF and what does it mean?

What is it and what are the advantages?

The Bitcoin ETFs are exchange-traded funds that track and mimic the value of Bitcoin. These are traded on traditional market exchanges and allow individuals and more importantly, institutions to indirectly invest in Bitcoin, without having to own or custody it themselves. In other words, the Bitcoin ETF will allow investors to seek return via the Bitcoin price, without actually owning the asset themselves.

These are extremely convenient to regulated institutions and risk averse individuals & entities as this investment vehicle simplifies the process of investing in Bitcoin without the risks and added steps associated with owning Bitcoin.

These ETFs can also diversify the underlying holdings and bring in other types of assets under the asset. In the US and most countries, ETFs are also eligible for investments via regulated tax plans, allowing investors to unlock tax efficiency benefits.

The last point is a very important one. This means that pension funds in the US, with Billions under management, can now start allocating capital into Bitcoin to potentially bring their investors higher returns. There are also other types of entities, such as insurers, credit providers, asset managers and many others who can now diversify their portfolios away from equities and properties, into Bitcoin as well.

The current queue of ETFs, as of 18 October, are the following:

Proshares and Valkyrie have gone live this past week and Van Eck, who has been waiting for years, will be going live in the next few days.

An interesting one to look at, is the Proshares ETF that will be tracking the Bitcoin price through futures contracts traded at the Chicago Mercantile Exchange (CME). I will explain why this is important a little later, but before that – let’s look at the disadvantages of the ETF.

Disadvantages of the ETF

When looking at the ETF through a Bitcoiner’s eyes, the first disadvantage is that one does not custody the Bitcoin themselves. Yes, one needs to go through the security steps of securing their Bitcoin and risks associated with it, but the entire point of Bitcoin is to allow everyone to be their own bank and not need permission to do what they want with their money.

If investors in ETFs also want an asset that is closely correlated with the Bitcoin price, they will struggle at times as many of the ETFs’ prices will be quite inaccurate against the BTC price, due to diversity of underlying assets.

And the kicker – management fees. Remember, once you have Bitcoin and are custodying it yourself, it costs you nothing to hold it. Other than spending a few hours per year to perform check ups or ‘health checks’ on your self-custody setup, there are no other costs. This is why active fund managers, unit trusts and similar parties will continue to fight Bitcoin and the proper education on this asset; as it’s going to be very tough for them to make fees or money out of it.

With ETFs, there will be quite hefty management fees (2-3%) and if this is charged in BTC, could place a lot of sell pressure on the Bitcoin price in the future.

Lastly, let’s talk about what could come out of all of this…

Like I said, it doesn’t look like the US will ban Bitcoin, but it is plausible to expect the powers that be will play nasty, rather than not. This is how they operate and always will, until the music stops.

But how could they manipulate Bitcoin? Well, if you look at Gold’s ETFs, many have said it is because of the ETFs that gold’s price has remained so low over time. This is another story and I would suggest watching a view vids on Youtube about this.

With the likelihood of most Bitcoin ETFs being Futures ETFs, like ProShares, Shorts and Longs now become implicit variables in the ETFs prices which will indirectly have an effect on Bitcoin’s price across all exchanges globally.

What if a central bank, with an endless amount of liquidity placed a short position on Bitcoin thereby driving the price down? What if their futures contracts end or at some point the shorts become ineffective, due to buy-side pressure. Well, they can settle their contracts with printed money any time they want. And then they can just open new short positions, over and over and over. This is a very similar story to what has happened with Gold, not exact, but quite similar.

However, the money printer can’t go on forever. Inflation can’t continue its trajectory without some critical mass being reached.

So, for now – hold your Bitcoin, don’t let others hold it for you and always think long-term. Rationality always beats irrationality.

And to conclude, with something a little positive, let’s look at Gold’s price, after the the Gold ETF was approved in 2004:

Bitvice Podcasts and Media

Brandon had a great chat with Kgothatso Ngako of Exonumia, who is trying to bring Bitcoin to 1 Billion people across Africa, through education. This is an awesome project, you can listen to the episode here.

Subscribe to our channel here to be the first to know when a new episode goes live.

By The Horns is a Bitcoin podcast about South Africa. You can follow our discussions via video on YouTube or via the audio version on Spotify, Google Podcasts or Apple Podcasts. If you are listening on a different podcast app, here is our RSS feed.