I’m sure this title caught your eye but rest assured, we’re not trying the clickbait tactics of News24. There are a lot of directions in which Bitcoin is going, but most people are primarily interested in the price. At Bitvice, we try to explain & debate Bitcoin’s technology, the principles, the economics, security, scams etc. but we thought it would be great to chat again about the ‘Number Go Up’ technology of Bitcoin.

We don’t want to focus on what the traditional finance system looks like at $1million per Bitcoin – because a lot of it would probably be a mess.

Rather, we want to focus on what could happen on its journey to $1million, the products built on Bitcoin, the socio-economic factors, privacy and other possibilities.

But first, the news.

1. Edward Snowden talks about CBDCs

You may have read our article on Central Bank Digital Currencies in a previous newsletter. You can read the original article here.

Mr Snowden just released an article about the dangers of CBDCs and how they will affect all of our lives. He went on to illustrate the exact same models outlined in our original article and similar socioeconomic factors of this authoritarian tool. We feel quite positive to be validated by Snowden himself.

CBDCs are knocking on our doors and it’s best to understand and prepare for their rollout. We will continue to keep you informed on all the happenings on South Africa’s own CBDC.

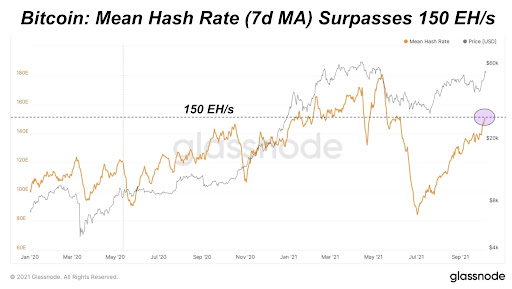

2. Bitcoin’s hashrate is making a comeback of the century

Bitcoin’s hashrate has just passed a 7-day average of 150 Exahashes per second. This means that thousands of ASICs around the world are executing one quintillion (1,000,000,000,000,000,000) hashes per second. It is only one hash out of all of these that eventually solves the puzzle and the miner who finds that hash, earns 6.25 Bitcoin.

We have written a few articles about Bitcoin’s hashrate in the past, because it is one of the most important aspects of Bitcoin. It is a component of its security and most certainly a primary driver of price (sometimes leading, sometimes lagging) due to its historical correlation.

The recent Chinese ban and hashrate wipeout in June/July certainly had an effect on Bitcoin’s price and more importantly, its security. But as you can see now, it will take more than a global superpower to take Bitcoin down.

As of 13 October, the USA has officially become the country with the most hashpower on Bitcoin’s network, with ~35%.

3. After a month, more people own Bitcoin than have bank accounts in El Salvador

And the best news of the week is how quickly Bitcoin has become the standard in El Salvador.

Banks have been in El Salvador for decades and yet, in one month, Bitcoin’s adoption outgrew them. Yes, even though the incentives were there to drive adoption – banks had all the time in the world to onboard as many users as possible.

And as of today, the subsidy that the citizens received from their government ($30 in Bitcoin) has grown by 40%.

This is the true power of an open, uncensorable network without bureaucracy.

There is also a growing narrative in Brazil that Bitcoin could be accepted as legal tender. We shouldn’t believe this just yet but if it becomes a reality; that’s opening Bitcoin to another 130million people.

Feeling Bullish yet?

What does the world look like at $1million per Bitcoin?

First of all you’re probably wondering if Bitcoin could possibly reach $1million? The short answer is yes. The only real questions are how long did it take to reach that mark and more importantly, how far has the US Dollar been devalued against what it is today?

We just saw Germany’s wholesale inflation rate reach 13.2% YoY which is most certainly not accurate against all types of products and assets. It is highly likely to be lower than the real, holistic rate. One can’t begin to think how fast inflation grows as the US is looking to print another $3.5Trillion. This is the big driver for Bitcoin’s price over time and unless the Central Banks halt all printing and return to the gold standard; inflationary forces will continue at erratic rates.

There have been a plethora of ‘experts’, ‘analysts’, financial celebrities and charismatic personas who have all called for Bitcoin to reach $1m by some future date – especially during the recent bull run in Q1/Q2 this year. Back in 2015/16, it was utterly absurd to quote such a price.

As Bitcoin will inevitably go over $100k in the near future, there will certainly be more speculative clamour and as the Bitcoin price increases over time, the future predictions will become crazier and crazier. Suddenly, $1m doesn’t seem so crazy anymore… That is what happened when Bitcoin reached $1, $100, $1,000 and so on. Price targets become larger, conviction becomes stronger, adoption increases and so the Lindy Effect continues its job.

As Bitcoin adoption continues to grow and irrationality fades into rationality through more serious adopters – many unproven, overhyped and ineffective altcoins become redundant and a serious amount of their initial demand is driven back to Bitcoin. This has occurred numerous times in previous cycles and due to the extreme speculation we are seeing in the markets now – it is highly likely to occur again.

Retail investors like you and I become more educated and experienced in this asset class and provide education to others to help them avoid the pitfalls of scams and alike.

However, so do the institutions become experienced and through that – they begin to manipulate this asset to bring them return and/or yield.

Institutional Adoption and CBDCs

Banks, fintechs and other financial institutions are facing a double-edged sword right now and in the immediate future.

They are being outpaced by Bitcoin but will also be outcompeted by CBDCs; dependent on their jurisdictions and regulations.

As all credit will be moved to Central Banks’ balance sheets; many banks will need to rethink their models and revenue streams. If the regulation allows, they will undoubtedly be swayed or even forced to adopt Bitcoin in one form or manner.

As Bitcoin’s price becomes larger and larger, banks will look to build financial products on top of Bitcoin and try to earn some form of fees from their clientele through this.

Some institutions, public and private, will try to destroy Bitcoin through regulation. It is what we are seeing now and this will only continue to grow in effort – as it is the only thing that politicians know how to do. However, it would be an interesting situation whereby institutions want this asset class within their products – so they wouldn’t want it banned outright. Pension funds, unit trusts and other investment vehicles will certainly bring Bitcoin into their holdings – directly or indirectly via an ETF.

So, as Bitcoin continues to $1m, more institutions will look at custodying Bitcoin on the behalf of investors. They would do this through forced regulation and propaganda. This way, less people actually have Bitcoin and the institutions grow their pools. This makes governments happy and this makes the banks happy. However, innovation from experienced Bitcoiners will undoubtedly ensure there are tools and methods to fight this. Self-custody and privacy will become easier, more secure and enterprises in regulatory-friendly jurisdictions will provide global solutions to allow users to hold Bitcoin themselves, in a private manner.

We will also see the rollout of central bank-approved applications to receive and distribute CBDCs to citizens of countries. There is a higher chance than not that social credit scores are coming our way (just like China) and based on your score; credit rates and overall terms of money will be determined upon these scores. Basically, George Orwell’s nightmare.

This will undoubtedly drive more and more people to adopt Bitcoin legally or illegally as the reality of this tool becomes clearer and clearer. Many people will choose freedom over their money rather than allowing others control over it. It is simply the evolution of current tax-haven mechanisms for offshore investments.

ETFs

We will also have Bitcoin ETFs and other similar market mechanisms in place by the time Bitcoin reaches the 5 and 6-digit marks. The gold ETF has evolved over the past few decades into a completely manipulated market and many experts see the suppression of the gold price due to this. It is only possible due to the non-transparency of gold’s supply that allowed the ‘paper’ market to grow. Bitcoin, however, is completely transparent via its ledger. It will be extremely difficult to create a ‘fractional reserve’ market around Bitcoin but there certainly will be people who will try. Good luck to them.

The Lightning Network

The most important thing to watch will be the Lightning Network. This is where incredible innovation will take place, as discussed in previous newsletters.

Bitcoin is the competition to Central Banks. The Lightning Network is competition to Mastercard, Visa, SWIFT and traditional remittance networks – all worth hundreds of Billions of Dollars.

It will also be a direct competitor to the players on the Forex markets, which drive Trillions in Dollars of volume per week.

The Network will also compete against messaging platforms such as Whatsapp, Signal and video platforms such as Zoom and Skype. This is because millions of ‘data packets’ can move within seconds.

Financial services, smart contracts and complex systems will be built on top of this network and the third layer (RGB) that will compete against betting platforms, lawyers, bureaucrats and a plethora of ‘middle men’.

This is only the tip of the iceberg and not even the most experienced product designers & developers can imagine what is to come our way.

All of the things that have happened and will happen will always have one constant – that there will only ever be 21million Bitcoin, for the entire human race.

Maintaining Privacy

I listened to a fascinating discussion with Saifedean Ammous (author of the The Bitcoin Standard) and Pete Rizzo this week about Satoshi Nakamoto, Altcoins and Bitcoin. It was a lengthy discussion but well worth your time.

There was an interesting question that was asked to Pete, about what difficulties Bitcoin will face in the long-term and if it could fail. Pete, who has been in Bitcoin for an extremely long time, does not believe Bitcoin ‘can be taken down anymore’. What he does worry about is that as soon as governments, regulators and alike truly realise this, they will turn their attention to those who hold Bitcoin themselves.

He has a thesis that Bitcoin holders will be turned into pariahs in the regulators’ eyes and so it is imperative to keep one’s Bitcoin secure and private.

As we outlined in a previous article, there are various tools out there to ensure your Bitcoin is kept in your cold storage privately. As most people buy Bitcoin on exchanges where their identification needs to be provided, the Bitcoin can be tracked on the ledger going forward – against your name. Tools outlined in our article can help separate your identity from your Bitcoin. These specific tools will continue to evolve and become incredibly important to Bitcoin holders.

As the value of Bitcoin goes up, so will your portfolio. It is always best practice to never share how much Bitcoin you have to anyone – nothing good ever comes out of that. Privacy will become increasingly important in line with the price of Bitcoin.

It is one of the most interesting times to have ever lived and it will only become more interesting every day. Bitcoin is volatile in price but more so in its developments. Something new happens every day, yet the blocks keep stamping every 10 minutes. As Bitcoin moves past $100,000, whenever that is, keep looking at the innovations of Bitcoin. Keep looking at maintaining security over this asset. Make sure you have a plan in place to pass this to beneficiaries. Keep a long-term perspective in place, ignore the noise and keep your eye on that $1million prize.

Bitvice Podcasts and Media

This week we will be having a chat with Handre van Heerden about all things Bitcoin. Handre has written some great articles and one of them has just been published in Bitcoin Magazine.

Subscribe to our channel here to be the first to know when a new episode goes live.

By The Horns is a Bitcoin podcast about South Africa. You can follow our discussions via video on YouTube or via the audio version on Spotify, Google Podcasts or Apple Podcasts. If you are listening on a different podcast app, here is our RSS feed.

Book a FREE 30 min call and get the answers that you need

As always, if you have any questions about Bitcoin, how to self-custody, how to keep it private or other specific questions; please reach out to Ricki for a free call.

Bitcoin is a complex subject that took us years to wrap our heads around, having somebody point you in the right direction could be helpful.

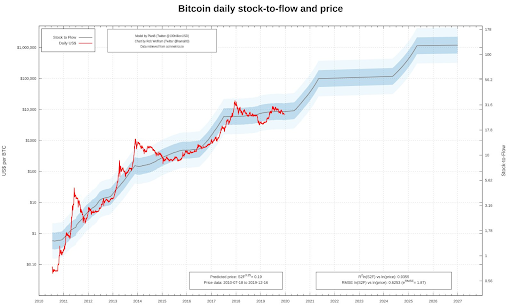

We hope you enjoyed this one and for the next few weeks, we’ll return our attention to the fundamentals and principles. For now, we’ll leave you with the latest Stock to Flow model from Plan B. Remember, models are always models until they are broken – but for now, we can enjoy the simplistic pattern of Bitcoin.

Have a great week!